US equity markets staged a harsh downside reversal Wednesday and closed the trading day lower in the wake of the remarks from Fed Chairman Ben Bernanke and minutes from the recent policymakers meeting that sparked fears of less easing in the near future.

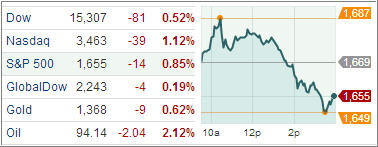

The Dow Jones Industrial Average lost 80 points (0.5%) to 15,307, the S&P 500 Index declined 14 points (0.8%) to 1,655 after early strength turned into afternoon weakness, and the Nasdaq Composite descended 39 points (1.1%) to 3,463. Those indexes had been up as much as 1.1%, 1.1% and 0.9%, respectively – new highs for all – before reversing. Volume swelled 25% on the Nasdaq and 34% on the NYSE.

All 10 industries in the Standard & Poor’s 500 Index declined. The utilities and telecom sectors led to the downside as traders continued to dump income-oriented names. Including today’s 1.6% decline, the utilities sector is down 5.0% month-to-date. Elsewhere, the energy space lost 1.2% as crude oil declined 2.1%. The energy component ended at $94.18 per barrel, and weighed on the growth-sensitive sector.

Another commodity-related group, materials, ended among the laggards as steelmakers under-performed The Market Vectors Steel ETF settled lower by 1.4%. Cyclical sectors felt the brunt of the afternoon weakness. Similarly, the Dow Jones Transportation Average was unable to escape the selling as the bellwether complex settled lower by 1.6%. Only consumer staples and health care were able to settle near yesterday’s closing levels.

As expected, Federal Reserve was in center stage of setting direction for stocks. Stocks rallied early in the day after the Fed Chief’s Bernanke acknowledged the drawbacks of persistently low rates but warned that a premature tightening of monetary policy could carry a substantial risk of slowing or ending the economic recovery and causing inflation to fall further.

He pointed out that although the job market has improved, it remains weak overall. This followed weeks of conflicting remarks from FOMC members, which sparked speculation regarding possible changes to the Fed’s policy course. However, those voices were echoed again by the afternoon release of the FOMC minutes from the May 1 meeting which revealed that some Federal Open Market Committee participants favor scaling back the pace of asset purchases, possibly as early as June, provided economic conditions warrant the change. Stocks fell soon after the release with the S&P 500 posting its biggest decline in three weeks.

Elsewhere, existing home sales rose 0.6% in April to a 4.97 million unit annual rate, the highest rate since November 2009 but coming short of an expected 1.4% increase to 4.99 million annual units. Median home prices increased 11.0% from a year ago, reaching its highest level since August 2008.

With the overall pullback in equities, it was no surprise that our Trend Tracking Indexes (TTIs) showed weakness as well with the Domestic TTI dropping to +4.36% while the International TTI ended this volatile day at +9.92%.

Looking at the big picture, this selloff was certainly way overdue given the relentless upward momentum of the past 6 months. It remains to be seen if this was the final blowoff or simply a one-day event. Whichever it turns out to be, you are well advised to be prepared for the former by having your exit strategy in place should this pullback turn into a full blown trend reversal.

Contact Ulli