Domestic equities closed sharply lower across the board today, with all sectors in the red, amid disappointing quarterly results by a batch of companies from Bank of America Corp. to Textron Inc., while commodities resumed their selloff because of ongoing worries over global growth; or lack thereof.

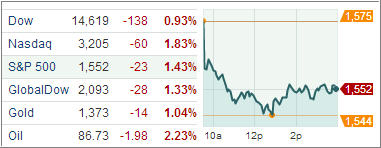

The Standard & Poor’s 500 Index declined 1.4 percent and erased all of yesterday’s gain. All 10 groups in the index declined as energy, technology and financial shares dropped the most. The Dow Jones industrial average was down 0.82 percent, which was its third-straight day of triple-digit moves.

The Nasdaq Composite Index suffered a 1.75 percent loss. Monday marked the sharpest one-day drop this year for all three major averages, before recovering most of those losses on Tuesday. With these sessions’ declines, the market is en route for its biggest weekly loss of 2013.

Among disappointed earnings, Bank of America Bank of America (BAC) was the worst performer in the Dow, sagging nearly 5% in heavy trade. The Charlotte, N.C.-based company posted net income of $2.6 billion in the first quarter, or 20 cents a share. That’s below the consensus estimate of 23 cents.

Investment banking fees enjoyed a nice pop; and if it wasn’t for Merrill Lynch’s revenue, this quarter could have been very ugly for Bank of America. As a member of the big-four banks, Bank of America too suffered from steep decline in lending mortgages.

The technology sector dropped sharply. Apple Inc. lost 5.4 percent to $403.26 and briefly fell below $400 for the first time since December 2011. A key supplier, chip maker Cirrus Logic, gave a disappointing revenue forecast, fueling worries about weakening demand for the iPhone and iPad. Energy and materials sectors were among the worst performers as oil and copper prices continue their free fall. Is this the end of the 12-year bull run of gold?

According to the Fed’s Beige Book business survey issued today, the U.S. economic expansion remained “moderate” amid gains in manufacturing, housing and autos. The survey is based on reports from the Fed’s 12 regional banks from late February to early April.

Economic reports from the U.S., China and Europe have been disappointing, causing oil to suffer the fourth drop of at least 2 percent this month. Weak fuel demand just adds more worries to the lack of economic growth, which I have been harping on for quite some time.

Again, while the stock market is artificially propped up thanks to the Fed’s ongoing money assist, the underlying economy is totally decoupled and continues to chug along at close to zero in terms of actual economic growth. It’s too early to tell if that fact has been finally realized.

Our Trend Tracking Indexes (TTIs) headed back south, after yesterday’s recovery and are sporting the folloing positions in regards to their long-term trend lines:

Domestic TTI: +2.80%

International TTI: +5.55%

Contact Ulli