US indexes fell for a second day, after the Dow Industrials reached record highs last week as a controversial bank tax levied by euro-area leaders on Cypriot bank deposits in return for a bailout reminded investors Europe’s debt problems are far from over.

Equities fell hard at the start as investors grew worried by news that euro area finance ministers forced bank depositors in Cyprus to share in the cost of rescuing the island nation, reducing the cost of bailout by EUR 5.8 billion to EUR 10 billion.

A parliamentary vote on the proposed levy due to take place today was postponed. Cypriot banks are closed until Thursday, a government official said. Under an unprecedented provisional agreement, the European Union has proposed a one-time tax of 6.75 percent on private bank deposits of less than EUR 100,000 and 9.9 percent for those over that amount. Markets are worried, and rightfully so, that such levies will could be used in larger economies, such as Spain and Italy in the future.

However, to levy deposits may hit Russia particularly hard as half of all bank deposits are believed to be Russian oligarchs. Moody’s estimate Russian corporate deposits are about $19 billion and any default could affect bank debt servicing in Russia.

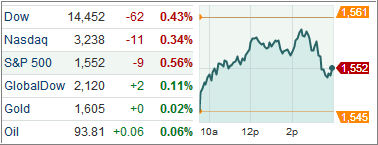

As a result, the Dow Jones Industrial Average (DJIA) closed a modest 62 points lower after losing over 109 points in early trade. The S&P 500 Index (SPX) trimmed 8 points to end at with financials fronting the losses and telecommunications the sole gaining sector among its 10 business groups.

Treasury prices advanced, pushing yields on 10-year notes down the most in three weeks, prompted by a proposed levy on all depositors in Cypriot banks as part of a financial rescue-plan for the island nation.

Treasuries trimmed early gains after European policy-makers signaled flexibility in regards to the application of the bank levy, saying easing the cost to smaller savers rested with Cyprus as long as they raise the targeted EUR 5.8 billion. A vote on the tax in the parliament was postponed by a second day until tomorrow.

The euro slipped on Monday after news broke out that Cyprus plans a one-time levy on bank deposits to comply with the conditions of international lenders.

European exchanges staged broad-based losses Monday with the Stoxx Europe 600 Index paring an earlier tumble as a controversial levy on bank deposits stoked fears the region’s debt crisis will reignite.

So far, the fallout/backlash has been very modest and our Trend Tracking Indexes (TTIs) changed only slightly from Friday’s close with the Domestic TTI slipping to +3.37% while the International TTI closed at +9.37%.

The intended Cyprus bank depositor levy can’t really be considered anything but outright theft of individual property. As such, this indicdent, no matter how it turns out, may have some serious consequences on the attitudes of European savers. After all, if it happens in one country, it can certainly occur in others as well should governments become desparate enough.

If it does, chances are the equity markets won’t react too kindly, so my past warning that a Black Swan event can derail this rally at anytime still stands. Right now, all is well in equity land but never forget that my recommended exit strategy may come in very handy by limiting your downside risk once a sharp trend reversal comes into play.

Contact Ulli