After a two-day advance, US stock indexes drifted lower today as investors lost risk appetite following the release of mixed economic reports, and European policy makers warned a strong euro could hamper the region’s recovery.

On the economic front, applications for weekly jobless benefits dropped to 366,000, down 5,000 from the previous week but above forecasts, Labor Department figures showed. Economists surveyed by Bloomberg had forecast 366,000 claims.

Meanwhile, the nation’s productivity, a measure of employee output per hour, dropped at an annualized two percent in the final quarter of 2012, said the Bureau of Labor Statistics. Following a 3.2 percent gain in the prior three months, that was the worst performance in almost two years.

In addition to economic data, investors sifted through comments from Chicago Fed President Charles Evans who said the Fed’s policies have already done a lot of good and he’s optimistic the economy will allegedly improve soon.

Stocks fell worldwide after European Central Bank President signaled policymakers were concerned about the euro’s recent spate of gains. Addressing a press conference in Frankfurt after today’s policy meeting, Draghi said the exchange rate was not a policy target, but it was important for price stability and growth.

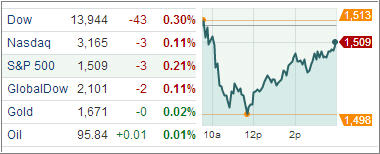

The Dow Jones Industrial Average (DJIA) fell 42 points recovering from a near 134 points fall.

The S&P 500 Index (SPX) slipped 3 points with materials and energy leading the decliners among its 10 major business groups. Eight out of ten groups in the benchmark index finished the day lower.

Treasuries advanced, holding yields below 2 percent for the first time in seven days after ECB President Mario Draghi kept interest rates unchanged after the bank’s policy meeting and warned the economic-recovery risks remained skewed to the downside, sustaining the safe-haven appeal of US debts.

The central banker left its key lending rate unchanged at 0.75 percent following a meeting of policy makers in Frankfurt today. Draghi said the 17-member currency bloc will start to recover later this year as absence of inflation will allow the central bank to keep interest rates at their record low.

The Stoxx Europe 600 index fell 0.2 percent to 283.88 after hitting as high as 286.20 following Draghi’s speech; it has now gone negative for the year.

Our Trend Tracking Indexes (TTIs) meandered with the major indexes with the Domestic TTI slipping to +3.16% while the International TTI ended the day at +10.82%.

The benchmark indices appear to be stuck in a tight trading range, and we’ve have to wait and see if the inevitable breakout occurs to the upside in pursuit of the S&P’s all-time high, or if the bears can gather enough strength to end this upward swing following Europe into negative territory.

Contact Ulli