US indexes did an about face and retreated in the final minutes of trading erasing earlier gains after a Senate vote kept $85 billion of automatic spending cuts in place starting at midnight, and data on growth and employment gave out mixed signals about the economy’s health.

Gains in the US equity averages fizzled out after the Senate rejected a pair of bipartisan proposals to replace $85 billion in automatic spending cuts starting tomorrow.

GDP growth reading also weighed on investors after a Commerce Department report showed the US economy grew by a negligible 0.1 percent in the final quarter of 2012 on an annual basis, up from the initially estimated 0.1 percent drop. The revised reading, however, was well short of the 0.5 percent growth economists were expecting. For all of 2012, the US economy grew at a 2.2 percent rate.

On an upbeat note, weekly jobless claims however, fell sharply by 22,000 to 344,000 last week, suggesting companies were looking beyond spending cuts by the government and were maintaining staffing.

Also, markets felt a small lift after a gauge of Chicago-area manufacturing rose to 56.8 in February from 55.6 in the prior month, the highest reading in eleven months.

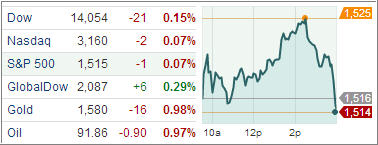

The Dow Jones Industrial Average (DJIA) finished 21 points lower after coming within 15 points of its all-time high 14,165, posted on October 9, 2007. The blue-chip index however, rose 1.4 percent for the month to log its third straight monthly gain.

The S&P 500 Index (SPX) shed 1 point to end at 1,515, 50 points short of its highest close. The benchmark index rose 1.1 percent for the month, its fourth straight monthly gain and the longest stretch since September.

Treasuries pushed higher Thursday with the 10-year benchmark notes gaining for the first month since November as investors sought refuge in safer assets amid political turbulence in Europe and the looming threat of sequestration in the US.

The US dollar firmed up against the euro Thursday as demand for safer assets increased after the Senate shot down a proposal to avert the so-called sequestration and economic data painted a mixed picture of recovery for the world’s largest economy.

European markets advanced Thursday to log its ninth straight monthly gain, a day after Fed chairman Ben Bernanke and the European Central Bank President Mario Draghi both signaled they would continue with the current easing policies.

The Europe Stoxx 600 index jumped 1 percent adding to a 0.9 percent gain from Wednesday and extending the pan-European index’s advance to 1 percent for February, marking its longest monthly winning streak since 1997.

Germany’s DAX 30 index climbed 0.9 percent Thursday, but finished the month 0.3 percent lower.

France’s CAC 40 index added 0.9 percent on the day, but shed 0.3 percent for the month.

The FTSE 100 index picked up 0.6 percent in London Thursday and finished the month 1.3 percent higher.

Our Trend Tracking Indexes (TTIs) edged slightly higher and ended the day/month at +3.12% for the Domestic TTI and +9.27% for the International TTI.

It remains to be seen how the indexes will respond to the mandated spending cuts starting as of Friday. Considering the overall debt level of the US and the fact that we are borrowing at a rate of $1 trillion a year, the cuts are hardly worth mentioning and are merely a rounding error; an impression which is not spread through main stream media reporting.

Contact Ulli