US stocks slumped Wednesday after a sell-off on Wall Street gained momentum as investors focused on the looming fiscal cliff and Europe’s debt crisis. The Dow Industrials logged its worst daily decline since November 2011 following President Barack Obama’s re-election Tuesday night.

Risk sentiment soured after violent protests broke out in Greece as the country’s parliament got ready to vote on further spending cuts and tax hikes. The European debt crisis came under focus after ECB President Mario Draghi said Germany, the region’s biggest economy that remained insulated from the crisis, has started to feel the pinch.

A European Commission report in Brussels revised the region’s growth forecast downwards to a paltry 0.1 percent in 2013, well below a previous forecast of one percent growth.

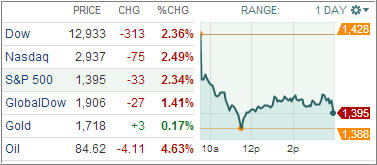

Led by JP Morgan (JPM) and Bank of America (BAC), the Dow Jones Industrial Average (DJIA) plunged 313 points, dipping below the 13,000 mark for the first time since September 4. Banks were the biggest drag on the blue-chip index on fears the stringent Dodd-Frank rules will come into effect in the next three to six months.

Slipping below the psychologically important 1,400 level for the first time since early June, the S&P 500 Index (SPX) tanked 34 points with financials pacing the decline. All the 10 business groups within the index closed lower. Coal producers were the worst hit on fears Obama’s re-election will mean tougher regulation for the coal industry.

The NASDAQ Composite Index (COMP) sank 74.64 points. For-profit education stocks, which have faced greater scrutiny under the Obama administration, were the worst hit.

The benchmark 10-year yields declined the most in five months as worries over the so-called fiscal cliff of spending cuts and tax increases spurred demand for safer assets. The political status quo following President Barack Obama’s re-election bolstered bets Fed Chairman Ben Bernanke will keep his expansionary monetary policies intact.

The US dollar jumped to a two-month high against most of its peers as concerns of going over the so-called fiscal cliff sunk US equities. The ICE dollar index, a measure of the greenback’s strength against a basket of six global currencies, rose to 80.781 from 80.606.

European stocks, after an early rally, ran out of steam on worries over the ongoing crisis’s impact on powerhouse Germany. A report showed German industrial production for September sank 1.8 percent. The Stoxx Europe 600 index slipped 1.4 percent after Fitch Ratings said the US must address the fiscal issues to retain its AAA rating.

The Athens General index shed 0.8 percent ahead of a crucial vote that will help Greece secure the next round of bailout money from its international lenders.

Banking stocks weighed on the DAX 30 index in Frankfurt with shares of Deutsche Bank AG and Commerzbank AG tumbling 4.03 percent and 2.88 percent, respectively.

The CAC 40 index gave up 2 percent in Paris after oil major Total SA sank 2.9 percent. BNP Paribas SA jumped 1.1 percent after the bank’s third quarter profits beat expectations.

The FTSE 100 index dropped 1.6 percent in London, dragged down by Royal Bank of Scotland and HSBC Holding. Energy major BG Plc shed 3.9 percent while oil giant BP Plc lost 2.5 percent.

In the ETF space, energy linked funds got battered following President Obama’s re-election. The United States Oil Fund (USO) sank 4.15 percent after oil futures tumbled nearly 5 percent today.

The State Street Financial Select Sector SPDR ETF (XLF) was also among the biggest percentage decliners, losing 3.34 percent during the session. Banking and insurance stocks took a hit over fears the stringent Dodd-Frank regulation will come into effect within the next six month.

Our Trend Tracking Indexes (TTIs) got hit as well, but remained above their respective long-term trend lines by the following percentages:

Domestic TTI: +1.13%

International TTI: +2.28%

The number to watch is the S&P’s 1,380 level, which represents its 200-day moving averages. If that gets broken, more selling will be a distinct possibility. Any increased downside momentum will cause our TTI’s break into bear market territory as well.

None of our trailing sell stops were triggered by today’s market plunge.

For quick access to the most recent StatSheet including TTI charts and all momentum figures, click here. You can read the latest ETF Model Portfolio update here.

Disclosure: No holdings in above discussed ETFs

Contact Ulli