US equity ETFs retreated Monday as political uncertainty in Europe continued to dominate the headlines with French President Nicholas Sarkozy losing the first round of elections to socialist presidential aspirant Francois Hollande. Hollande has been openly hostile to Sarkozy’s austerity proposals and has vowed to tax the rich if voted to power.

The Netherlands’ coveted AAA rating came under pressure after the Dutch coalition government collapsed over austerity-measure disputes. Signs of yet another slowdown in the Chinese manufacturing sector spooked investors further as the markets braced for a week heavy on economic and earnings data.

I don’t know how else to say it, but Europe is a basket case. For some always entertaining yet brutally honest and correct comments on this topic, here’s Nigel Farage addressing the UK parliament:

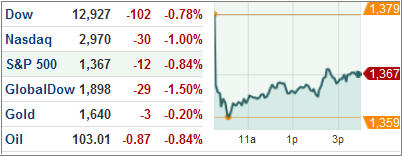

The Dow Jones Industrial Average (DJIA) lost 0.8 percent with all but 3 of the 30 components in the red, as discount retailer Wal-Mart sank 4.7 percent amid bribery charges in Mexico.

The S&P 500 Index (SPX) slipped 0.8 percent to settle at 1366.94 while the NASDAQ Composite Index (COMP) dropped shed 1 percent to close at 2970.45.

Yield on 10-year benchmark bonds dropped 3 basis points to a near two-month low of 1.93 percent as worries over European crisis lingered on, pushing Treasuries up for the fourth day. The yield on 30-year bonds slid four basis points to 3.08 percent, the lowest since March 6.

ETFs in the news:

The ProShares UltraShort Russell MidCap Growth (SDK) jumped 5.93 percent on a day when broad market indices tumbled. This fund seeks to return twice the inverse of the daily performance of the Russell Midcap Growth Index. Due to increased market volatility, this ETF, being a leveraged product, may witness greater swings. Not recommended if you are a conservative investor.

The iPath S&P 500 VIX Short Term Futures ETN (VXX) climbed 3.32 percent as global macroeconomic data remained shaky and political developments in the Europe continued to disappoint. The so-called fear-tracking VIX benchmark locked into April highs as risk remained off the table.

The United States Natural Gas Fund (UNG) rose 4.79 percent following a prolonged and uninterrupted downward journey. The natural gas futures tracking ETF is showing strength in an uninspiring global environment.

Among the day’s losers, the ProShares Ultra MSCI Mexico Investable Market (UMX) remained ahead of the pack as investors remained wary of emerging markets. This ETF seeks to replicate twice the daily equity market performance of Mexico and displays wide swings due to 2X leverage.

As the Eurozone continues to show signs of political instability and stress, Europe-related products got hammered. The iShares MSCI Sweden Index Fund (EWD) tumbled 4.55 percent, as day-to-day European developments appear chaotic. As I mentioned before, you better stay away from that region for the time being.

Our Trend Tracking Indexes (TTIs) headed south, but remain on the bullish side of the equation. Today, they closed as follows:

Domestic TTI: +4.01%

International TTI: +2.01%

Disclosure: No holdings

Contact Ulli

Comments 4

Thanks for the commentary. I have some tza, but do you think the mid cap is a better shot? It is only a double vs a triple and I do like that.

ulli,

it is all such a crock. you go on and on explaining all the reasons the market fell today. when it goes up tomorrow, does that mean that everything you said was wrong concerning all the countries and all the problems enumerated? it is just too much like a world wide computer game with the rules set up to guarantee a long interesting ride but inevitable eventual failure.

the identity of the puppeteer is unknown, but the strings controlling the market are all too obvious.

as gordon gekko said “the market is a zero sum game”. that means that new money is always necessary to be taken from the suckers. similar to a las vegas craps game, if you play the market long enough, the house will always win-just ask bill miller.

wise up, ulli. we are all suckers.

bill diehl

Doug,

I don’t know your circumstances, so I can’t answer that. The main thing is that are disciplined when it comes to exiting your position in case it goes against you.

Ulli…

Bill,

Then you should not be in the market at all. I am trying to look at the big picture here and be prepared to exit the market should bearish forces become dominant. Along the way, I try to educate the investing public as best as I can with what I know and have experienced.

What are you doing to make the world a better place?

Ulli…