US stocks slipped to their lowest level in nearly a month Wednesday following a weak Spanish bond auctions report that revived the specter of the Greek debt crisis being repeated.

Markets were also spooked as investors remained worried about how markets would react without further monetary stimulus from the Federal Reserve, as the bunch bowl got taken away yesterday, driving Treasuries higher as safe-haven appeal of US debts increased.

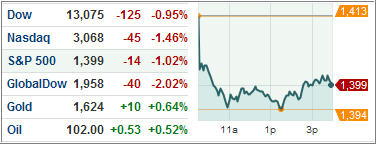

The Dow Jones Industrial Average (DJIA) shed 1 percent as the markets witnessed pull-backs following steady gains made during the first quarter. Payroll processing firm ADP’s report showing a lower-than-expected rise in private-sector jobs in March aggravated the situation further.

Financials led the decliner’s pack Wednesday while the telecommunications sector advanced the most in the 10-sector index.

The S&P 500 Index (SPX) lost or 1.0 percent and the tech-laden NASDAQ Composite (COMP) shed 1.5 percent, capping its worst session in 2012 to close at 3,068.09.

US Treasuries recovered from their biggest drop in nearly three after yields after crisis-stricken Spain’s bond auction failed to charm investors and yields jumped by 26 basis points to 5.71 percent, reviving memories of the Greek crisis.

ETFs in the news:

As stock indices across the spectrum marched south, the fear-tracking iPath S&P 500 VIX Short Term Futures ETN (VXX) jumped 2.23 percent on the day. The fear index is powering higher, registering its third day of gains, as markets struggle to find a strong footing.

As risk appetite starts to weaken, the iShares Barclays 20+ Year Treasury Bond Fund (TLT) managed to recoup some of recent losses after falling to its 200-day moving average, gaining 1.37 percent on the day.

Among the day’s top losers, Market Vectors Junior Gold Miners ETF (GDXJ) tumbled 4.20 percent as gold continues to slide following the FOMC data. With today’s drop, the fund is heading towards fresh 2012 lows.

The iShares MSCI South Africa Index Fund (EZA) lost 3.49 percent Wednesday, as minerals-heavy emerging market funds got hammered following materials and miners’ retreat. Traders are selling off bullion positions as short-term inflation worries eased following the release of FOMC minutes indicating a halt in monetary stimuli.

Commodity related funds are showing greater volatility as China shows signs of slowdown. The Market Vectors Rare Earth/Strategic Metals ETF (REMX) lost 3.35 percent on a day when both equities and precious metals retreated.

Worries over unsustainable debt levels continue to spook Europe-linked funds with the iShares MSCI Germany Index Fund (EWG) dropping the most among its peers. EWG lost 3.11 percent, while other Europe-related products like the iShares MSCI France Index Fund (EWQ) and the iShares MSCI Sweden Index Fund (EWD) also made sharp retreats.

Our Trend Tracking Indexes (TTIs) pulled back as well, but they both remain on the bullish side of the trend line with none of our Model ETF portfolio holdings triggering any trailing sell stop points.

The TTIs ended the day as follows:

Domestic TTI: +4.58%

International TTI: +3.77%

Disclosure: Holdings in TLT

Contact Ulli