The Dow staged a late-session comeback to break a two-session losing streak even as US stocks ended mixed Thursday.

A raft of weak economic numbers, including a higher-than-expected jobless claim, soured investor sentiments driving both the NASDAQ and the S&P 500 lower for the second day in a row.

Strong demand for Treasuries pushed yields down as investors rushed to seek refuge in safe-haven assets as European debt worries continue to spook markets.

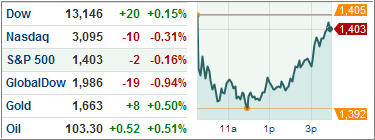

The Dow Jones Industrial Average (DJIA) climbed 0.2 percent after slipping in early trade, while the S&P 500 Index (SPX) shed 0.2 percent but is still higher 0.4 percent for the week. The index has added more than 11 percent this year.

The tech-heavy NASDAQ Composite (COMP) dropped 0.3 percent, restricting weekly gains to 0.9 percent.

Treasuries advanced as demand at the auction of $29 billion seven-year securities was the strongest since August. Following ratings agency Standard & Poor’s disclosure yesterday that Greece may require further debt restructuring, foreign central banks scooped up US debt.

ETFs in the news:

As uninspiring economic numbers muddled investor confidence, the iPath S&P 500 VIX Short-Term Futures ETN (VXX) jumped at first but ended up losing 0.52 percent, after two straight sessions of gains.

The iShares Dow Jones U.S. Healthcare Providers Index Fund (IHF) is heading towards all-time highs after bottoming out in October. Up 1.36 percent on the day, the fund led the day’s gainer’s pack.

The iShares Barclays 20+ Year Treasury Bond Fund (TLT) jumped 0.75 percent, bouncing off its 200-day moving average, while Currency Shares Japanese Yen Trust (FXY) added 0.47 percent in choppy trading. Barclays Aggregate Bond Fund (AGG) also gained today in the fixed income space, adding 0.3 percent on the day.

The iPath Dow Jones UBS Natural Gas Subindex Total Return ETN (GAZ) sank 6.40 percent, pushing the instrument back to its pre-February levels. Despite its recent lows, GAZ’s premium still stands at about 60 percent. Another natural gas product – the United States Natural Gas Fund LP (UNG), also lost favor with investors and slipped 5.3 percent. It’s been clear for some time that these ETFs have been firmly entrenched in bearish territory.

Global X Uranium ETF (URA) dropped for the third consecutive day, losing 2.25 percent on the day. URA has touched its lowest since mid-January as the alternative energy sector continues to get hammered.

The iShares MSCI Italy Index Fund (EWI) slipped 2.55 percent as Spanish and Italian debts have started to rattle world markets. A few Asia linked funds including the Market Vectors Vietnam ETF (VNM), the iShares MSCI Taiwan Index Fund (EWT) and the iShares MSCI Hong Kong Index Fund (EWH) also featured on the day’s top loser’s list.

It was a day that could have been far worse but, as we’ve seen quite often lately, the early sell off reversed at mid-day, and the major market ETFs engaged in “melt-up mode” limiting early losses. Giver the elevated levels of the indexes, I have to wonder how long these sudden rebounds can keep the markets from going through a much needed correction.

Disclosure: Holdings in TLT

Contact Ulli