Last week’s market pullback did affect all of our portfolios, although only one position slipped enough to trigger its trailing sell stop. As I posted last Friday, that was the volatile commodity sector, in which we had holdings via the DBC index, which were sold.

The winner for last week turned out to be the ETF income portfolio (#5), which barely budged and has now taken the top spot in terms of YTD performance.

With the sale of DBC, we had some extra funds available, which I was able to re-deploy today via the purchase of another sector ETF.

Let’s look at the portfolios in order:

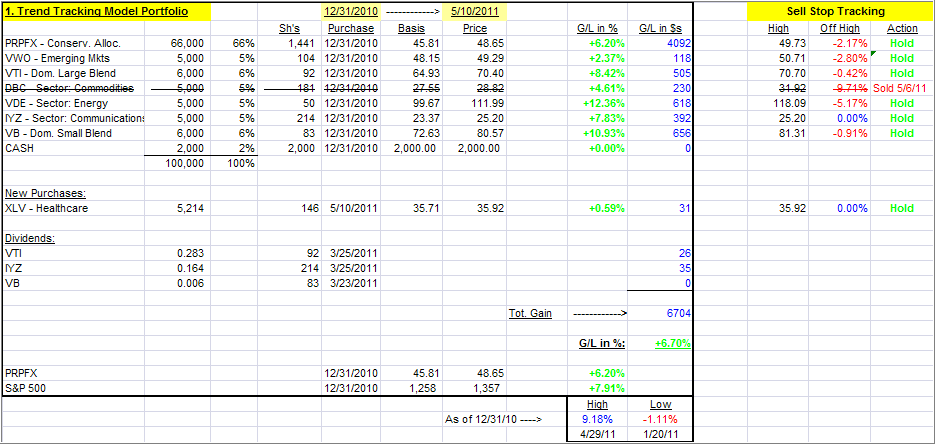

1. ETF Trend Tracking Model Portfolio

[Click on any table to enlarge, copy and print]This is the portfolio allocation I predominantly use in my advisor practice. Given current market conditions, and an ever growing number of global hotspots, I like the concept of having a solid core holding in PRPFX.

Around this fund, I have added what I call boost components consisting of ETFs that can produce higher returns than my core holding, at least during bullish periods. When a market pullback occurs, the core holding should add an element of stability.

This is exactly what happened early in March 11, when the double natural disasters struck Japan. While the S&P 500 lost all of its YTD gains, and dropped into negative territory, this portfolio stayed positive.

Nevertheless, as you know from my writings, anything I invest in involves the use of trailing sell stops, which are shown and tracked on the upper right of the table. The proceeds from the DBC sale were replaced today with XLV (Healthcare), which I actually purchased in my advisor practice.

Last week, this portfolio was up YTD +7.55% vs. +6.70% as of today.

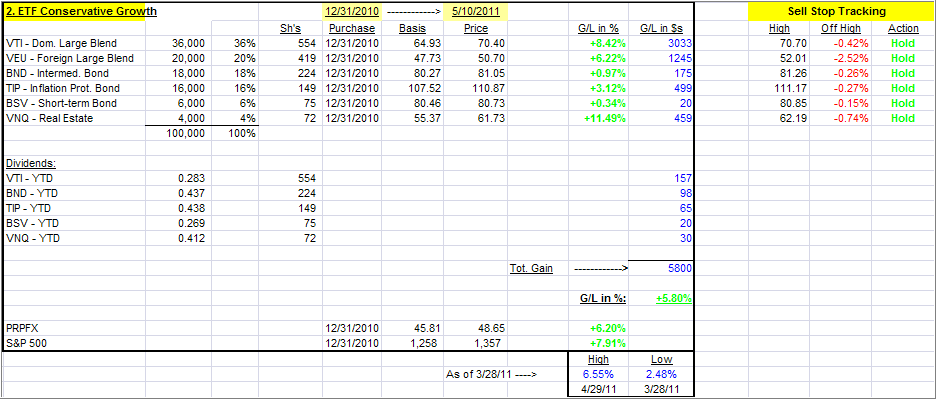

2. Conservative ETF Growth Portfolio

This portfolio, as are the following ones, would be typical of what is being used in the buy-and-hold community, as you can see by the 40% allocation to various bond ETFs. If you are conservative, this simple combination could work for you, but I still recommend the use of the trailing sell stops during these uncertain times.

Last week, this portfolio was up YTD +5.85% vs. +5.80% as of today.

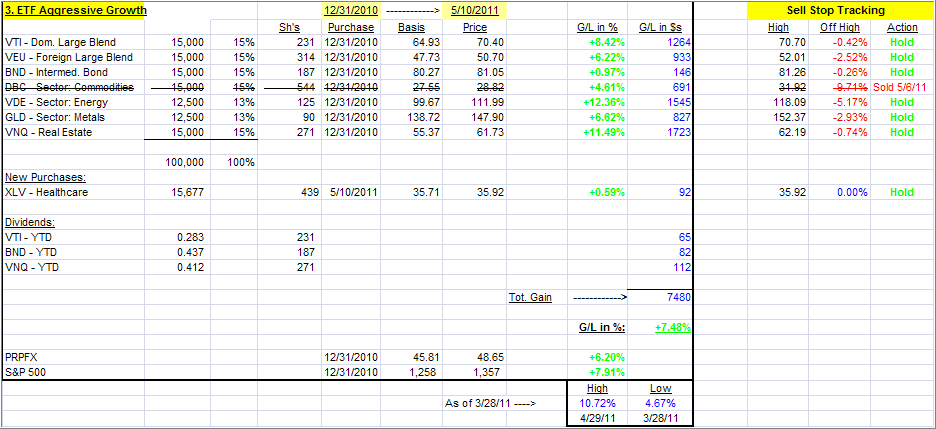

3. Aggressive ETF Growth Portfolio

What makes this one aggressive is the 15% allocation to bonds. This portfolio is leading the bunch on a YTD basis, because we are in a bullish period. When a correcion occurs, this one will lose value faster than all of the others.

However, if you have an aggressive streak in your personality, you could consider this one. If you use my recommended sell stop discipline, you know exactly ahead of time what your risk will be. Here too, I used the proceeds from DBC to invest in XLV.

Last week, this portfolio was up YTD +9.08% vs. +7.48% as of today.

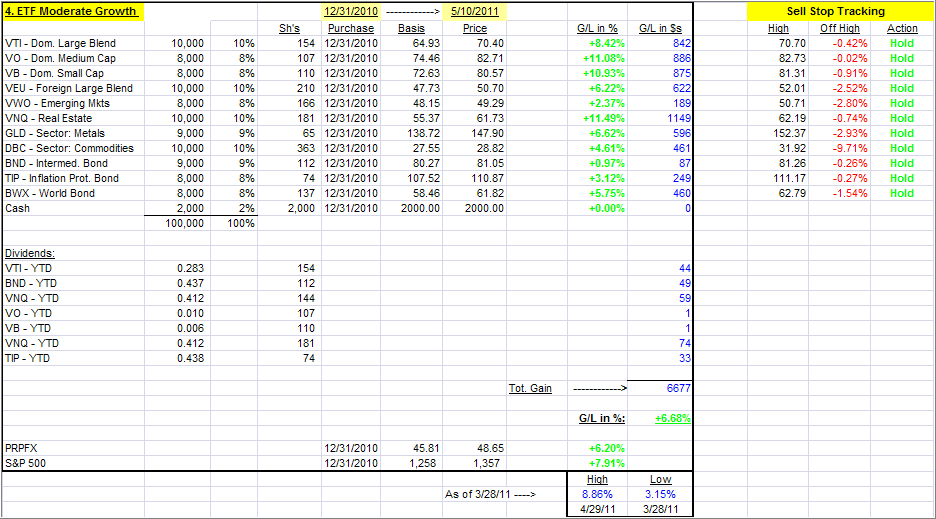

4. Moderate ETF Growth Portfolio

I call this one moderate growth, because of the higher allocation to various bond ETFs (26%) than in the aggressive set up above. It is also more diversfied domestically, but as the YTD return shows, that does not seem to matter much as it is pretty even with my Trend Tracking Portfolio.

Last week, this portfolio was up YTD +7.61% vs. +6.68% as of today.

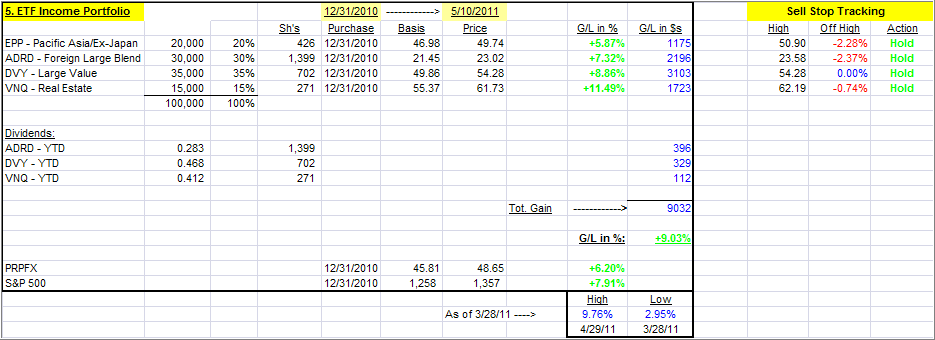

5. ETF Income Portfolio

This is as simple as it gets, but in the current market environement, this portfolio now ranks #1. Howver, when a market set back occurs, this one could drop in value quickly due to no offsetting bond positions, but it did not do so last week. Be sure to use a 7% sell stop on all holdings.

Last week, this portfolio was up YTD +9.23% vs. +9.03% as of today.

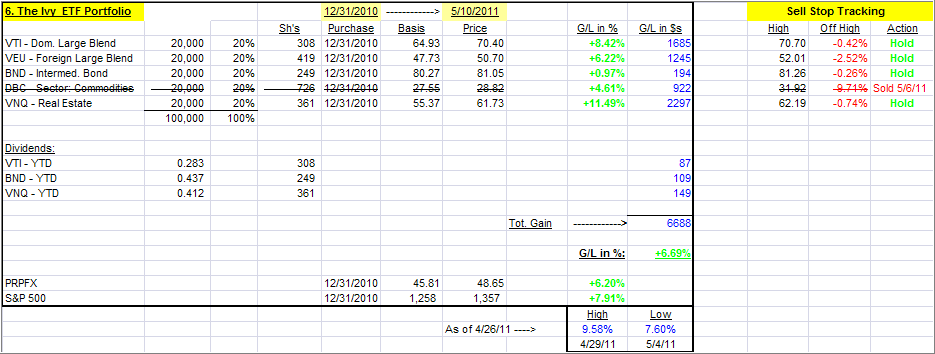

6. The Ivy ETF Portfolio

If you missed the recent post about the Ivy portfolio, you can read it here.

This is a simple 5-asset class portfolio with each individual component being bought when it crosses its respective trendline to the upside. Each component is being sold once it crosses its trend lines to the downside again, according to the author’s rules.

I have made 3 adjustments:

1. I apply a 39-week Simple Moving Average (SMA) to generate the Buys, while the authors use a 45-week SMA.

2. As mentioned in the blog post, I prefer using my trailing sell stop discipline for my exit strategy.

3. Personally. I favor using BND (as opposed to IEF) as my bond component, since it has shown more stabilty in the past.

This portfolio was also affected by the sale of DBC. I will re-enter this position once it has taken out its old high of 31.92 to be sure that any rebound is not just another headfake.

Last week, the Ivy portfolio was up YTD +8.47% vs. +6.69% as of today.

To repeat, the key to selecting a portfolio from the above list is not just performance. Personally, I’d rather lag a little on the upside but have some assurance that I will also lag when the downside comes into play.

This will help you to sidestep whipsaw signals on occasion, which are caused by temporary market pullbacks followed by a subsequent resumption of the previous up trend.

I will update these portfolios every Wednesday and inform you via email that the updated versions have been posted.

Quick Reference:

Contact Ulli

Comments 18

Hi there Ulli;

Just to prove to you that I am paying attention, it appears that you did not delete DBC from #4 portfolio. I think I should get extra credit for this astute observation.

Best,

John

Hello, Ulli,

Thanks for publishing the 6ETF MODEL PORTFOLIOS. They are a wonderful value to me. I do, however, have difficulty reading the light green text in the charts; not enough contrast from the white background. Enlarging the charts by clicking on them doesn’t help much. Any chance of making it dark green and/or using bold text?

Thanks for all you do.

Guy

John,

I appreciate you paying attention, and you deserve extra credit for my error. I have made the correction. Somehow this week, my error quotient has been extremely high. I try to do better next week.

Thanks,

Ulli…

Guy,

That is strange, because when I enlarge mine, the green colors are crystal clear. Has anyone else had this problem?

Ulli…

Hi Ulli,

First, thank you very much for sharing all the ETF information you post.

Yes, I agree that the green text would be improved if it was darker. Enlargement (very nice) makes them legible, but it is very difficult to read them without the enlargement, at least on my monitor. Monitor size and settings probably impact this.

Best Regards,

David

Your publication is great. What do you recommend as a Trailing Stop Lose Order

percentage? Are there different TSLO %’s based on volatility?

Anon,

The sell stops are 7% and 10%. You might want to download my free e-book on the subject:

https://theetfbully.com/newsletter-sign-up-thank-you/

Ulli…

Hello Ulli –

I also have trouble reading the charts. Enlarging them only makes the fuzzy characters larger but no easier to decipher.

Thanks, Gary

Gary,

That seems to depend on the monitor you use. My display is crystal clear when enlarged; nevertheless, I changed the green numbers to dark blue, which should help. Look for it next Wednesday.

Ulli…

Very nice selection of funds, I wish I would have stumbled across them earlier,,, I well keep my eye on the site for furure selections, thank you.

One other thing yes the ligh green is hard to see I have to use a mgnifieing glass to read it, otherwise all is fine.

OK Geo; as I mentioned already, I changed it to blue. See next Wednesday’s post.

Ulli…

First, thanks so much for offering this information. I have been a firm believer in PRPFX for a long time. Concerning the green highlight color, my i – mac shows it as fairly light green on the page but becomes a clearer and somewhat darker green when I click on to expand the first portfolio. As an aside, what makes the income portfolio which is doing very well, an income portfolio? Is it because all the etf’s pay a dividend? It seems like a pretty feisty income portfolio to me!

Paul,

As mentioned, the color scheme has been changed to blue. Take a look next Wednesday…

I agree with you on the income portfolio being feisty and somewhat aggressive. I saw that some major advisory firms were using it and added it as an interesting option. It’s certainly not one I would use without trailing sell stops.

Ulli…

Several of the ETF’s in your 6-model portfolios have exceeded a 5% gain. Would you still increase your investment in each position as it reaches that point? Perhaps I have missed something. Also, if one of the ETF’s gets stopped out at -7% (like DBC) how do you go about replacing it to keep the portfolio in balance. I really appreciate how you always bend over backwards to satisfy your readers. Exceptional for a free service. Thanks

Chuck,

The 5% gain has nothing to do with anything. I allocate only a certain percentage to a sector, and then let that holding run until the trend ends, reverses and stops me out. After we got stopped out of DBC, I noticed that XLV had been trending opposite of the S&P 500, and thought it might be an appropriate addition.

However, I do not feel obliged to replace a sold holding if I feel there is nothing worthwhile to replace it with, if momentum is weakening. I have no problem with a higher cash position in this environment.

Ulli…

I would like to invest using one of your model portfolios.

Can I start now? what percentage of my investment should I start with?

Peter,

That depends on your risk tolerance. If you are conservative, you might want to allocate only 33% of available assets. If you are moderate, you might use 50%. No matter which way you go, be sure to use my recommended sell stop discipline.

Ulli…