Following a recent wave of optimism, markets began to slightly retreat today after yesterday’s relatively flat performance. The S&P fell 0.3% although the NASDAQ rose 0.60% due to positive tech news, further bolstered by Google’s greater than expected third quarter earnings, resulting in a 6% boost in after hours trading that might carry on into tomorrow.

Meanwhile, Oil and gold dropped 0.28% and 0.35%, respectively, inching back after both were almost down 1.5%. Also, the VIX nearly breached the 20s range, dipping to 30.70, providing some ease after a period of nervously high volatility.

With regards to earnings, J.P. Morgan had disappointing earnings with a 33% drop in profit as a result of lower investment banking and trading revenue. This is a negative sign given that J.P. Morgan was one of the relatively unscathed banks from the financial crisis that has performed well during the downturn. Let’s just say that already unattractive financial services sector ETFs just got uglier.

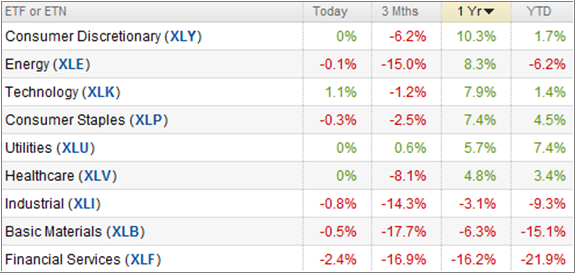

However, are there some other sector ETFs that show promise?

Yesterday, I indicated that if we have reasonable basis to believe that a rally may continue, we might want to look into some potential sector ETFs. In the meantime, below is a snapshot of sector ETF performance:

For more detailed momentum numbers, please refer to today’s updated StatSheet, which will be posted later on.

Despite the lack of detailed plan outlining European bank recapitalization, Slovakia’s ratification of the EFSF expansion measure certainly cooled some nerves today. However, major challenges lie ahead as to how the Eurozone will get out of this vicious borrowing cycle and achieve long-term debt reduction.

On the Asian front, Chinese export growth fell during September due to weaker consumption trends in advanced economies, another possible indication that China’s economy is slowing down given recent pullbacks in commodity prices such as copper. This was further evidenced by a drop in oil today in tandem with China’s lower export volumes.

The question remains as to whether equity ETFs have experienced a momentarily positive blip and will soon fall back into the red again and head towards the lower end of the trading range. But with uncertainty still surrounding Europe’s strategy now that the EFSF expansion has been given the go-ahead, and anticipation surrounding the Fed’s decision regarding QE3, I’m still adhering to my bond ETFs/cash position.

Contact Ulli

Comments 2

Ulli, I agree with your bond ETF/cash position, for several reasons. The European’s “big plan” to stave off, not only the Greece crisis, but future crises, is to have the banks, in Europe increase their capital reserves. Sound familiar? While the U.S. had the bailout for the big banks, the Europeans don’t, and do you think the European banks’ ownership and management really want to increase their capital reserves, just to have it “hanging around,” in case they need it to rescue European countries, like Greece, Ireland, Spain, and others who overspend. This sounds like the formula for gridlock, to me. We know what happens, when investors perceive that major areas of the world’s economy are in gridlock. Again, sound familiar, to what’s happened and happening in America?

Also, Congress’ “Supercommittee” will be giving its recommendations, November 23rd, that is, if they can agree on any, which is doubtful, since both parties stacked the deck, with whom they appointed to the “Supercommittee.” If, by chance, the “Supercommittee” does come out with some recommendations, they have to pass both the House and the Senate, without any amendments, at all, and the President has to not veto them, in order for them to become law. What do you think the chances of that are? Not!

So, I think, American investors, always looking for good news, but reacting very strongly to bad news, after the financial meltdown, are going to realize that not only are we in a recession, which the government said officially ended on September 10, 2010, (Right! Great propoganda. Just get out of the White House, look at the country, and be honest with us: we’re in bad shape, economically.) but the country is also in gridlock. And remember what happened to the stock market, once the country realized we were in gridlock, last time.

I think we’re in for a bear market, when investors realize all of this. I think the S&P could drop to 1000, 950, or even 900. Your advice is sound: caveat emptor — for now.

JC,

You are correct with what you say. I am most curious about what the German/French power couple (Sarkozy and Merkel) will actually come up with when they announced the grand master plan around 10/23. Personally, I don’t think much of their ability to create a positive shock and awe effect.

Ulli…