Today’s rally received support after the August Fed meeting showed that some officials are in favor of another move that might boost the economy, although there was no overall consensus.

A second assist came from the president of the Federal Reserve Bank of Chicago, who chimed in that he would back more stimulus efforts as well. Lovely; since QE-2 did nothing for Main Street but everything for Wall Street via a nice rebound, let’s be sure to do more of that. Go figure…

While equity ETFs closed modestly higher, precious metals were the main beneficiaries of these announcements with gold surging back above the $1,800 level with interest rates heading lower again.

Somehow economic reality is not something that matters to Wall Street right now, but eventually it will. Consumer confidence plunged to its lowest level since March 2009, which is the infamous month the major averages hit their lows after the 2008 crash. With the consumer contributing almost 2/3 of economic activity, this does not bode well for the future.

The main focus during the remainder of this week will be Friday’s employment report which, based on current data, makes it questionable whether nonfarm payrolls will be showing any growth.

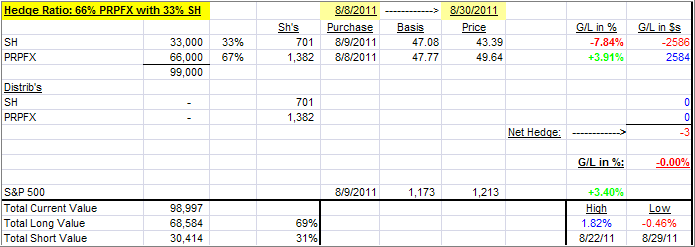

In the meantime, our hedge improved from yesterday and has reached the breakeven point, as the matrix shows:

Again, since the markets did not succumb to bearish forces yet, as I had anticipated, the short component of the hedge has been a bit of a drag on performance. On the other hand, we have reduced downside risk considerably, in the event the markets take a tumble all of a sudden.

This could very well happen on Friday, should the unemployment numbers turn out to be as dismal as some of the above figures seem to indicate. I still favor being more cautious and hedged despite the recent rebound, until all players return in full force after the Labor Day weekend.

Contact Ulli