The markets took another nosedive today as Morgan Stanley warned about a global recession, which caused 10-year Treasury yields to drop below 2% as the flight to safety continued.

As a reader of this blog, the dreaded “R” word (as in ‘Recession,’ not in ‘Recovery’) should be a familiar tune, as I have commented about this very possibility for quite some time.

The sovereign debt crisis, along with weak domestic economic data combined forces to push all major market ETFs substantially lower, as the chart above shows (courtesy of MarketWatch.com).

The Trend Tracking Indexes (TTIs) joined the slide and have reached the following points in regards to their long-term trend lines:

Domestic TTI: -0.34%

International TTT: -11.54%

As you can see, the Domestic TTI has again slipped below its long-term trend line confirming the initial break into bear territory from last week. However, the drop below the line is very minor, so I would expect more of the trend line dance to continue.

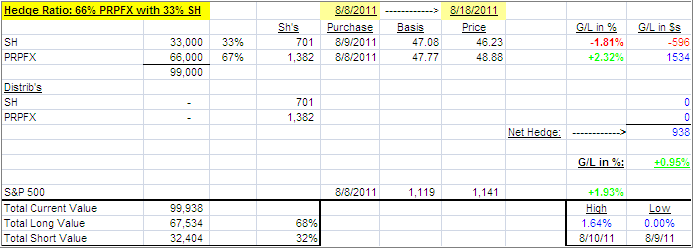

Our PRPFX hedge reacted to the sell off exactly as planned by gaining some 0.65% on a day where equities got clobbered. Here’s the updated matrix after the close:

Having this set up in your current portfolio will give you piece of mind and will let you sleep at night no matter what the markets throw at you.

Even if you kept PRPFX as an outright long position, subject to my recommended 7% sell stop discipline, you came out way ahead today as this fund dropped a reasonable -1.09%, while it has come off its high by only -2.10%.

If you have only minor holdings in PRPFX and don’t want to bother with hedging, you can certainly hang on to this fund and apply the above mentioned exit strategy. In my advisor practice, I do that very same thing with small accounts.

We have again reached a point of great uncertainty. While in bear market territory, we may see sharp and vicious rebounds, but I believe that, at this point, the long term trend is down and momentum could easily accelerate given the fact that there are no good solutions to the European crisis and no visible drivers to support the theme of an economic recovery.

Stay conservative and do not seek any exposure to equity ETFs at this particular time.

Contact Ulli