Meandering around he unchanged line was the theme of the day until the last hour, when the bulls shifted into high gear and propelled equity ETFs to a third gain in a row supported by a better than expected durable goods order report.

Additionally, with the beating of the financial stocks over the past few months, there may have been some inkling that a potential bottom was in, after the 18% drop since

April and that in general stocks were cheap. Support for the S&P 500 is lurking at the 1,120 level, which has been touched seven times since August 8.

The whipping boy of the past couple of days was predominantly gold as the precious metal came sharply off its highs by some 5% today. No surprise there, since any asset class that rallies over 25% in less than 2 months is clearly subject to a correction.

Margin calls for buyers at higher prices may have played a role in the sudden pullback while central banks around world remain buyers of gold.

In regards to PRPFX, as well as its ETF equivalent, it was a down day as most of its components headed south, including bonds, gold, real estate, Swiss Frank and silver. It was just one of those days to serve as a reminder that there is no such thing as a perfect investment.

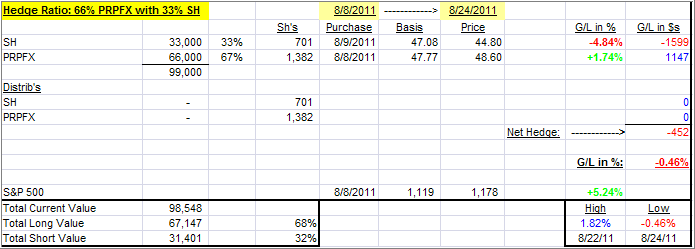

Our hedge has moved slightly into negative territory as the matrix shows:

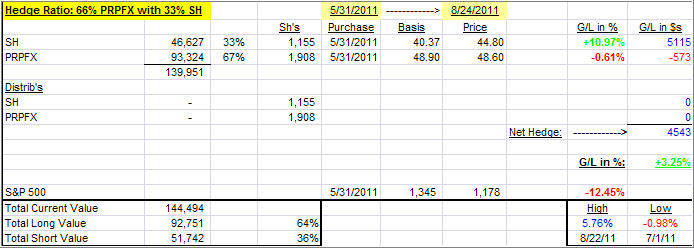

To get a little longer term view, here’s my personal hedge again, which I initiated on 5/31/11:

It clearly demonstrates the benefits of such a set up if the market head south. Right now, we’re caught in a bit of an updraft, and it’s too early to tell if that is a real turnaround or another head fake.

Our Trend Tracking Indexes (TTIs) are showing the following positions:

Domestic TTI: +0.35%

International TTI: -9.76%

Currently, my focus is on the domestic index as it continues to hang around its trend line without making a clear move to either side. With the GDP number/revision being on the menu tomorrow, and the Fed’s widely anticipated assist on deck for Friday, we hopefully will see some trend clarification.

If we go higher over the next couple of days, I will remove the short component of the hedge next week. If we go lower, which there is a good chance should the Fed’s anticipated assist disappoint, we will keep our positions. Again, I’ll let the market tell me what my next move has to be.

Contact Ulli