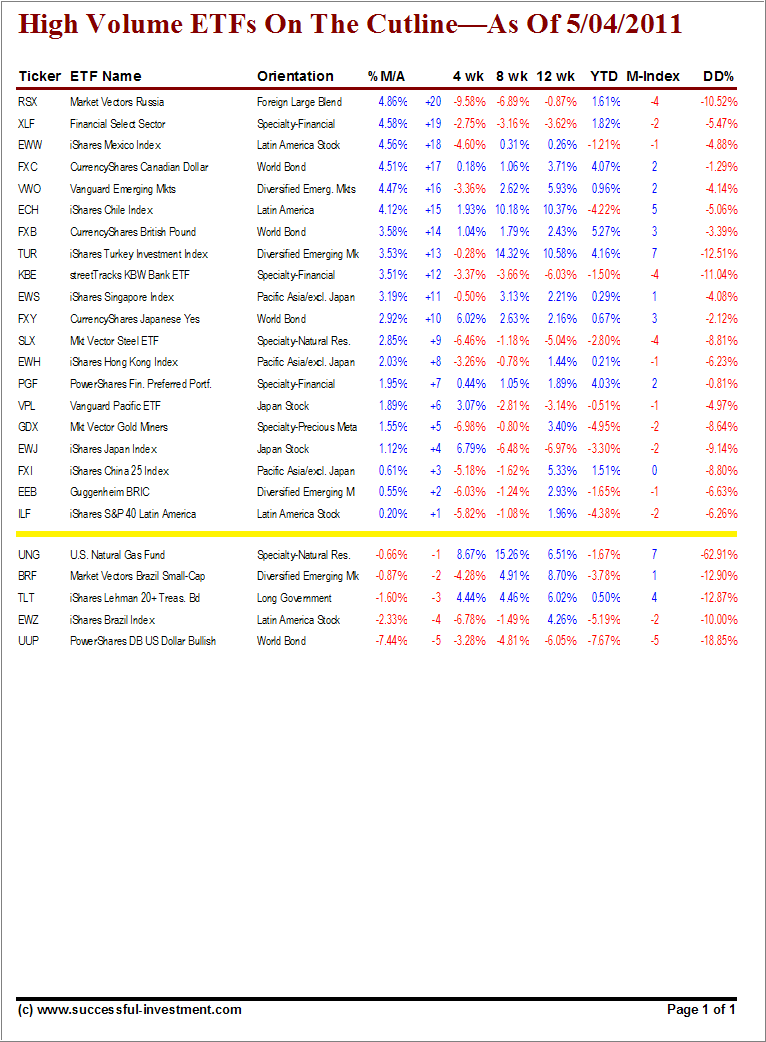

Here’s the latest update of the High Volume only ETFs, which are hovering slightly below and above their cutline (trend line). High Volume (HV) ETFs are defined as those with an average daily volume of $10 million or higher.

These ETFs are generated from my selected list of 90 that I use in my advisor practice. It cuts out the “noise,” which simply means it eliminates those ETFs that I would never buy because of their volume limitations.

With the markets being in correction mode over the past 2 trading days, there were some surprise moves to the downside and the upside. The more volatile BRF sold off sharply and dropped from a +16 position to -2, ending up below its long term trend line. ILF followed closely but remained at +1, which represents the first ETF above the line.

On the positive side, there was one ETF, which bucked the sell off and actually climbed up the food chain from +2 to +7. For new money, this is the only buy on this week’s list.

Let’s look at the table first:

[Click on table to enlarge]The ETF I am talking about is PGF, which has moved from +2 to a +7 position. All momentum figures are positive across the board, and PGF has come off its high by only -0.81% (DD% column).

If you have new money to invest, this might be a good selection, subject, of course, to my recommended sell stop discipline.

If you are a new reader and missed the original Cutline report, which also featured some “how to use” information, please review it here.

Quick Reference:

Disclosure: No holdings in ETFs discussed

Contact Ulli