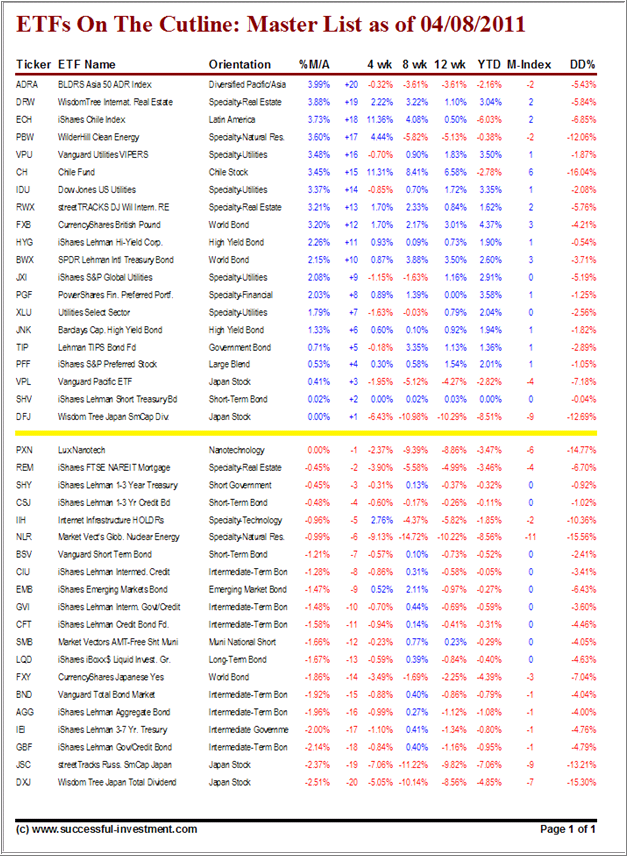

In this second edition, you’ll notice that ETFs do not remain in the same position in relation to the cutline for very long. This week’s exception would be DFJ, which continues to hang around the +1 placement.

Then there are fast paced ETFs like TUR, which was in a +3 position last week and catapulted off this table by having moved +4.55% above its long term trend line.

Others, like RWX, moved down from +20 to +13.

Take a look at this week’s table:

To quickly compare this week’s activity to last week’s, you can reference the previous cutline report here.

If one of the ETFs you are tracking appears no longer in this table, it means that it has moved beyond the 20 plus or minus positions shown here. That is what happened to TUR, and you need to consult the current ETF Master List to find its location.

Please note that, as markets change direction from bullish to bearish, you will eventually also see bear market ETFs move through the cutline as they gain momentum. With that in mind, the cutline concept is as important during good times and bad times alike.

Contact Ulli