Japan will need to bounce back from its tragedy; no question about it. Are there any ETFs you could invest in that cover the rebuilding effort? According to MarketWatch, “Buy what Japan needs to rebuild:”

The tragedy in Japan is still unfolding, and the extent of the devastation is uncertain, but there will come a time when the country will rebuild.

When that happens, the reconstruction effort will be massive and lengthy, and will involve both Japanese and international companies.

With that in mind, Standard & Poor’s highlighted some of the companies and industries that could see greater demand for their products and services as Japan recovers.

The disaster in Japan could impact supplies of crucial business components. Here’s what some companies are doing to deal with the situation.

S&P’s list of stocks and exchange-traded funds for investors to consider is a grim reminder of the gargantuan scale of work that lies ahead, yet underscores the fact that Japan will spend what it must to speed the recovery of its economy and its society.

Japan’s economy is the third largest in the world, but its growth had been anemic even before the natural disaster struck. As a result of the quake and its aftermath, Japan’s economy will grow 3% in 2012, according to economic forecaster IHS Global Insight.

The S&P selections aren’t so surprising — concentrated on building materials, engineering and construction firms that will be called to repair and rebuild Japan’s housing and infrastructure, and oil refiners that could meet the country’s energy needs now that its nuclear power industry is crippled.

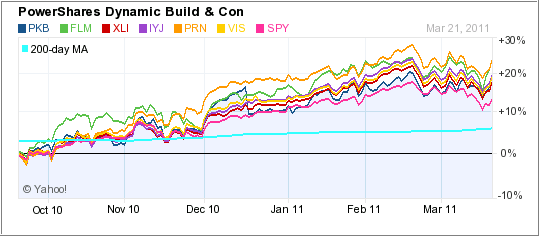

The article mentions several ETFs, which I have charted above against SPY for comparison. All have outperformed the index over the past 6 months, but be aware that some of them are fairly small with low volume and not suited for many institutional investors.

Sticking to the major indexes will very likely have you participate in a Japanese recovery as well. Why? These days we are all globally joined at the hip. I don’t see any major region being in a roaring bull market while another one gets stuck in bear market territory.

While the magnitude of any bullish advances may differ, eventually, a rising tide will lift all boats.

Contact Ulli