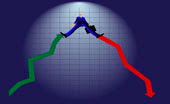

Stop loss questions are continuing to be the hot topic. One reader posted the following comment:

Stop loss questions are continuing to be the hot topic. One reader posted the following comment:

Have you considered stop loss based on volatility? It is very complex and tricky but better than straight 7 or 8% one fits all.

To be clear, I already differentiate to some degree. My 7% rule applies only to all “widely diversified domestic and international funds/ETFs.” For more volatile sector and country funds, I use 10%.

To slice and dice this further by determining that one ETF with higher volatility should have a 7.75% sell stop while another one with less volatility should have a 6.58% exit point, is simply making things too complicated.

While this may be an interesting project for someone with lots of time on his hands, the differences in outcome maybe minute. I like to look at the big picture and have a plan in place to get out of a position when the trend goes against me. That’s it—no more no less.

You have to remember that this is not an exact science, but merely a method to limit risk. As such, I do not believe carrying this to an extreme will have any advantages. However, if you do engage in this project with your own investments, feel free to share your experiences with me.