My latest No Load Fund/ETF Tracker has been posted at:

http://www.successful-investment.com/newsletter-archive.php

Lack of confidence in the recovery pulled the markets down for the 4th week in a row.

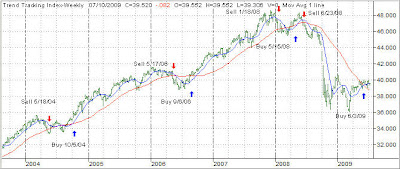

Our Trend Tracking Index (TTI) for domestic funds/ETFs has now crossed its trend line (red) to the upside by +1.75% keeping the current buy signal intact. The effective date was June 3, 2009.

The international index has now broken above its long-term trend line by +6.42%. A Buy signal was triggered effective May 11, 2009. We are holding our positions subject to a trailing stop loss.

[Click on charts to enlarge]

For more details, and the latest market commentary, as well as the updated No load Fund/ETF StatSheet, please see the above link.

Comments 2

Ulli,

Thanks for your work and free weekly letter and daily blog. Isn't the reason that your TTI is still above the long term trend line because as your TTI line drops so is the long term trend line, which actually could go on for a while yet and forcing all the stops to be triggered?

Anon,

With the downward momentum of the past year, trend lines tend to overshoot to the downside before they turn around. They smooth out the daily price fluctuations, which is why they don't react as quickly as you might think.

Ulli…