Reader Peter had these comments recently:

I always enjoy your daily Blog and I do follow some of your investment principles. Keep up the good work.

Today I have a question about “Buy & Hold.”

There has been considerable press lately (since the market chaos during the last year) about the death of buy and hold.

Have you done any studies to compare your investment strategies to see how they would stack up against the typical “buy & Hold” over the last year? I am really interested in any studies that you may wish to share with us.

A point that I think is important is to not just compare figures with the S&P; 500, but also Europe and Emerging Markets. Any Buy & Holder with “brain in gear” can be expected to be diversified across the global markets.

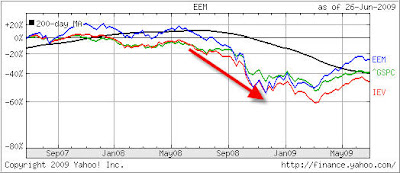

There is not much research necessary to evaluate how diversification across the globe has fared during last year’s market collapse. Let’s take a look at a chart comparing the S&P; 500, with Europe (IEV) and the emerging markets (EEM) over the past 2 years:

[Click chart to enlarge]

As is the case most of the time, a picture is worth a thousand words. All equity markets declined with utter abandon, and that is no surprise. Equities will benefit only in a bullish environment to varying degrees and will collapse when the market turns bearish.

This is simply common sense and not rocket science. And nothing is more uncommon than common sense when it comes to investing.

Many investment professionals either don’t have a clue how to indentify a turn in market direction or, if they do, they may not want to take any action as explained in “The Naked Truth.”