My latest No Load Fund/ETF Tracker has been posted at:

http://www.successful-investment.com/newsletter-archive.php

Increased unemployment figures today did not derail the gains made earlier in the week.

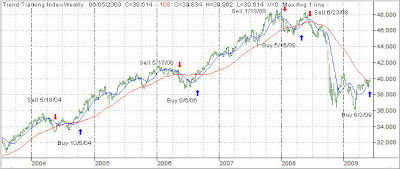

Our Trend Tracking Index (TTI) for domestic funds/ETFs has now crossed its trend line (red) to the upside by +0.80%% keeping this week’s buy signal intact.

The international index has now broken above its long-term trend line by +9.47%. A Buy signal was triggered effective May 11, 2009. We are holding our positions subject to a trailing stop loss.

[Click on charts to enlarge]

For more details, and the latest market commentary, as well as the updated No load Fund/ETF StatSheet, please see the above link.

Comments 7

Ulli,

As of today, our Trend Tracking Index (TTI—green line in above chart) has broken below its long term trend line (red) by +0.87%.

This statement confuses me. I thought when the green line was below the red that was a sell or out of mkt (yur 7% notwith standing.) So if one has not gotten into the mkt wud yu recommend them waiting until it crossed above the red again.

For help with a trailing stop loss, there are inexpensive websites:

tradestops.com

exitpoint.com

The cost is small compared to a loss due to not selling when you should have.

Another method to setting and monitoring a stop loss is at smartstops.net.

All have good information worth reading. The alerts provided by these sites make monitoring stops simple. Using a website vs a local program is helpful when traveling. It is easy to monitor and update.

There are advantages to monitoring vs setting a sell stop order with a broker. Both have their place depending on what you are trying to accomplish.

In this market, I use 1/5 vs 1/3 as a guide on how much to invest at a time and a 5% gain before allocating more to a position. Asset allocation is a bit more challenging.

Another good site to check out is finviz.com. I have several watch portfolios to monitor ETF's in different areas (sector, index, global, commodities, etc). With this and Ulli's tracker, I can find ideas to help with asset allocation.

From Ulli's commentary:

– We made our investments (acted on the signal)

– We have established our exit points (set trailing stops)

– We will fine tune based on the market (monitor and adjust)

Oops my typo. It should read…..has broken "above" its long term trend line…

Ulli…

Ulli: I am looking at the ETF GUR covering the eastern europe market. It is abve the 200 day MA? Can I invest 10% of my portfolio in this, subject to the 8% sell stop rule? Thanks for your guidance.

Annon,

Yes you can as long as you are diligent about following your sell stop discipline.

Ulli…

Many thanks for your always timely replies.

Ulli,

The first message above by a dude named Anonymous must not be able to read here is what was said: Our Trend Tracking Index (TTI) for domestic funds/ETFs has now crossed its trend line (red) to the upside by +0.80%% keeping this week’s buy signal intact. Anon said you said it went below the line. Hummmmmmmm!