My latest No Load Fund/ETF Tracker has been posted at:

http://www.successful-investment.com/newsletter-archive.php

In a repeat of last week, the major indexes closed slightly lower.

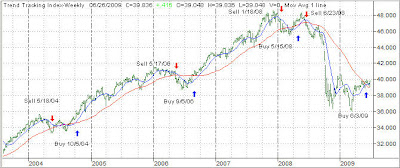

Our Trend Tracking Index (TTI) for domestic funds/ETFs has now crossed its trend line (red) to the upside by +2.46% keeping the current buy signal intact. The effective date was June 3, 2009.

The international index has now broken above its long-term trend line by +9.22%. A Buy signal was triggered effective May 11, 2009. We are holding our positions subject to a trailing stop loss.

[Click on charts to enlarge]

For more details, and the latest market commentary, as well as the updated No load Fund/ETF StatSheet, please see the above link.

Comments 2

Ulli,

How long did it take you to be disciplined to follow your trend change in the contexts of all your emotion that a market may be just ""too high"" when it turns positive to reinvest.

Is that still a very powerful force. You even seem to hedge your rules a bit waiting for the price to go 'X' amount your trend line.

Is that a big advantage of a fee based service to invest others funds. There is not much in this economy or earnings that justify any rise in the mkt even 6 months out. When the mkt rises because unemployment figs were only 500,000rather then 525,000 or whatever is testament to a certain amount of decoupling at least my perspective. So mechanical or fee based service may eliminate shoudl intrepretation.

Anon,

I will respond via a blog post within a few days since you brought up some good points.

Ulli…