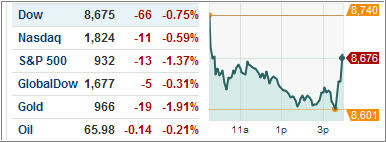

It could have been a lot worse yesterday but, as we’ve seen quite often lately, a last hour buying spree limited the risk of a nasty slide.

It could have been a lot worse yesterday but, as we’ve seen quite often lately, a last hour buying spree limited the risk of a nasty slide.

Despite Fed Chairman Bernanke’s rhetoric that the recession will end this year, the markets seemed to ignore his words of encouragement.

The main focus this week will remain on Friday’s employment numbers. The expectation is that “only” 500,000 jobs were lost. If the real number comes in close to that, it would be interpreted that things might be “less bad” as in the recent past, which could provide fuel for another rally.

If the number comes in considerably higher than expectations, all bets are off.

As of yesterday, our Trend Tracking Indexes (TTIs) are showing the following positions:

Domestic TTI: +1.02%

International TTI: +8.84%

Hedge TTI: +1.54%

We continue implementing our plans as posted previously.

Comments 5

Is there criteria other than M-Index number for selecting the optimum funds to enter? Is the higher number simply the better fund technically?

Anon,

A fund/ETF with a high M-Index ranking simply means that it has outperformed others. That's a good thing but it also means that during a correction this fund will lose more quickly.

Personally, I drop down on the ranking list to avoid too much volatility.

Ulli…

Would you please tell us how you divide the investments between domestic, international and emerging markets. Do you follow a particular percentage allocation to each?

For example, few weeks back when international gaave a buy signal (when domestic did not) – why not invest 100% in international? How do you decide on the allocation rule?

Many thanks for your time.

Anon,

When a buy signal is triggered, I usually commit only 1/3 of portfolio value to that arena. If the trend continues upward and I gain 5%, then I commit another 1/3. If in the meantime another area signals a buy, then I commit 1/3 to that one.

That's my preference, but you can do it anyway you're comfortable as long as you keep the exit strategy in mind.

Ulli…

Many thanks for the clarification.