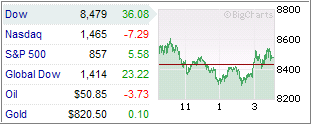

It was a see-saw day on Tuesday as the major averages struggled to hold on but managed to eke out a small gain.

It was a see-saw day on Tuesday as the major averages struggled to hold on but managed to eke out a small gain.

The Fed’s announcement that it will buy up to $100 billion in debt issued by Fannie and Freddie was well received along with news of new efforts to ease strains in the consumer credit markets.

The new Term Asset-Backed Securities Loan Facility (TALF) is supposed to lend up to $200 billion to institutions issuing consumer debt such as credit card loan, student debt and auto loans. In other words, while the government will not make such loans directly, it supports them by buying them as asset backed securities from those who actually do the lending.

I am not sure if there will be strict guide lines or if this will be a step back into the history of real estate lending where the separation of loan originators and servicers brought about nothing but fraud and deception.

Due to the Thanksgiving holiday, I expect the markets to meander for the rest of this week until everyone is back full force on Monday.

Comments 1

Ulli Have a happy THANKSGIVING and I want to thanks to you for your service. Snoobers