I have mentioned from time to time that many investors (or advisor clients for that matter) have very good intentions, but seem to fight a constant battle with their short-term fear pitted against their long-term resolve.

Many times, the former wins handily and the latter, which is more important, succumbs to the fear of being too worried about short-term losses. I suppose that any psychologist would confirm that fear is a far stronger emotion than great intentions.

Even if you could have omnipotent abilities to look into the future, your emotions most likely would not change. Let me prove that point.

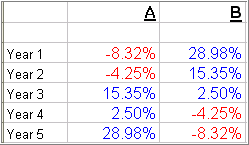

Take a look at the following set of numbers:

Assume that, with your omnipotent abilities, you could be assured that two investment approaches (A and B) would be able to produce those annual returns over the next 5 years. Which one would you select?

If you’re like most investors, you would choose the one featured in column B. Why? It’s off to a great start, and your short-term fears about losing are alleviated.

However, if you knew your numbers you would have realized that this was a trick question. The figures are identical in both columns, only the sequence is different. After 5 years, the returns are exactly the same!

The point is that an investor with a long-term resolve in an investment approach would have done just as well with the figures in column A even though the first two years might have had him question the soundness of his selection.

The key to using any investment approach is twofold. Don’t let emotions get in the way of sound thinking and find one that you are comfortable with so that you can stick with it for the long term.