Morningstar re-launched its Stewardship Grades for Mutual Funds a few days ago designed to reward the industry’s best stewardship practices. So far, it has shown Clipper funds (CFIMX) to be a standard bearer for corporate governance.

Morningstar re-launched its Stewardship Grades for Mutual Funds a few days ago designed to reward the industry’s best stewardship practices. So far, it has shown Clipper funds (CFIMX) to be a standard bearer for corporate governance.

OK, I am all for improvements in this area, but I don’t select a fund just based on these new criteria. Take a look at CFIMX, which has net assets of over $3 billion. Year-to-date (as of 8/31/07) it has a negative return of -1.09% according to Yahoo Finance.

Hmm, let’s assume for a moment that the average investor has $50k invested in this fund. That means, with over $3 billion in assets, there are about 60,000 investors who are exposed to a fund with A1 corporate ethics, whose portfolios have gone down in value.

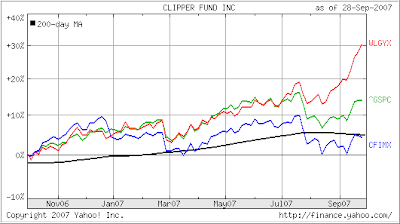

Comparing this fund with the S&P; 500, and one of our current holdings, WLGYX, and you can clearly see that this is, to say it politely, not a fund you want to own. Take a look at the chart:

To be clear, out of 117 Large Blend funds in my data base, this one ranks in the bottom 5. The top ones show a YTD return of around +19%.

My point is simply that it is noble to support causes you believe in. However, it is important to distinguish between being engaged in worthwhile endeavors and making decisions which may jeopardize your portfolio growth along with your future retirement.