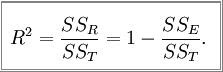

From time to time, you may come across some investing terminology and see terms like “R-Squared” used in an article. The formula is represented in the picture on the left and, if you’re a math wiz, you devour things like this for breakfast.

From time to time, you may come across some investing terminology and see terms like “R-Squared” used in an article. The formula is represented in the picture on the left and, if you’re a math wiz, you devour things like this for breakfast.

For the rest of us mortal human beings, here’s the definition by Vanguard:

“R-squared measures how much a fund’s past returns can be explained by the returns from its benchmark index.

If a fund’s total returns were precisely synchronized with the index’s return, it’s R-squared would be 1.00 (100%). If a fund’s return bore no relationship to the index’s returns, it’s R-squared would be 0.

The higher the R-squared, the more the fund’s return can be explained by the performance of the index, and so the performance of the market or market segment. The lower the R-squared, the more the return can be explained by the fund manager’s decisions.”

When would this be important to you? Most of the time, it does not matter, but when you invest in some of the newer more esoteric ETFs, which are all supposed to track an index, and the ETF performance differs from the underlying index performance, you now know why: Based on the above explanation, R-squared is less than 1.

It does happen occasionally, as I posted about in “ETF News: Straying From The Index.”

Contact Ulli