A couple of days ago, I posted about investments in Eastern Europe and especially focused on EUROX, which had performed extremely well in the past.

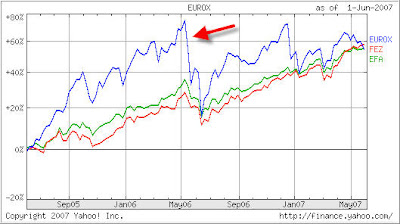

In reviewing the chart again, I need to point out that there is another important lesson to be learned when looking at the comparison with FEZ and EFA. Here’s the graph again:

As you can see, during the market meltdown of May/June 2006, EUROX pulled back sharply, recovered, dropped again and is now just about on even par in regards to performance (for this 2-year period) with FEZ and EFA.

If you had applied a trailing sell stop, as I recommend, you would have been stopped out at a great profit somewhere in the area of the arrow (May 06), which was the time when we liquidated most of our positions. It is important to take profits from a fund that has had a great upside but is also subject to heart stopping drops.

As the market recovered further, EUROX has remained fairly flat since September 06 and has bounced around the unchanged line without offering further upside momentum.