The following story made me chuckle because the answer surprised me and may surprise you as well.

The following story made me chuckle because the answer surprised me and may surprise you as well.

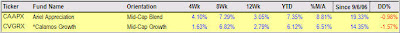

MarketWatch had an interview with Morningstar mutual fund analyst Marta Norton. The point of the interview was Marta’s contention that funds should earn their place in your portfolio by “meeting future expectations” rather than past performance. As an example, she mentioned CVGRX and CAAPX.

Hmm. How do you do that?

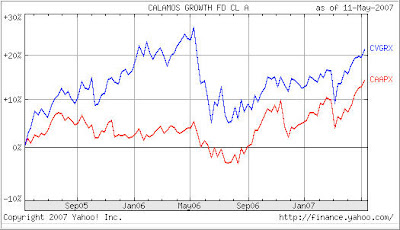

Being a numbers person, I first compared the 2 funds against each other over 2 years, 5 years and 10 years. The 2 year comparison is shown below:

To prove her point, however, Marta put a hold rating on CVGRX suggesting that recent performance and asset growth could hinder future returns. At the same time, she put a Buy on CAAPX.

This is confusing. Morningstar has always promoted their star rankings as the ultimate in comparing funds before you buy. Has that now changed? Are they weighing other factors?

Comments 4

You showed the two-year pricing. On the one-year chart, CAAPX looks better, like in your StatSheet. I don’t know if your price graph is adjusted for distributions. When I look at BigCharts.marketwatch.com, the distributions are not taken into account on the graph.

Morningstar also publishes Pick/Pan ratings to show their future outlook, which doss not have to be correlated to the star rating, which is based on past performance adjusted for volitility.

Yes, the 1-year chart showed a better performance from CAAPX; all longer-term charts showed the opposite.

Since Yahoo Finance shows adjusted prices in their price history, I would assume that this applies to their charts as well—but I can’t be sure.

Moringstar also rates these funds as follows:

CAAPX – Medium Blend, Low Risk, Below Average Returns, 67th in its category (last year)

CVGRX – Large Growth, Above Average Risk, Below Average Returns, 82nd in its category (last year)

CAAPX is no-load with ongoing expenses of 0.75%

CVGRX has a 4.75% sales load, a 2% redemption charge and ongoing 1% expenses.

Bottom line, both of these funds are losers, and one charges a high load! It’s like asking would you rather be eaten by a tiger or a lion – how about neither!

Yes, I hope nobody took my comparison as a buy recommendation, because it was not meant to be one! I simply used it to make a point about the Morningstar story. I agree, “neither” is the correct answer.