My latest No Load Fund/ETF Tracker has been posted at:

http://www.successful-investment.com/newsletter-archive.php

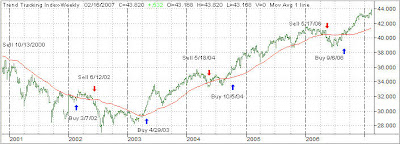

The markets rallied sharply this week after soothing comments from Fed Chairman Bernanke about the economy. Our Trend Tracking Index (TTI) for domestic funds moved higher as well and now sits +6.10% above its long-term trend line (red) as the chart below shows:

The international index also moved higher and currently sits +11.07% above its own trend line, as you can see below:

For more details, please see the above link.

Contact Ulli

Comments 2

“…take some money off the table…”

This is a phrase I see used often on discussion forums across the internet. And today I read a MarketWatch article emphasizing this same idea to prompt their readers to (I’m paraphrasing), “prepare for a correction.”

Personally, I don’t consider myself smart enough to know when, or exactly how, to “take money off the table.” I understand the idea: taking profits from high-performing investments before they reach their climax and subsequent fall, probably falling hard. And reallocating these funds to so-called or hopefully “safer” investments like bonds or under-performing asset classes, asset classes that, in theory, would not be closely correllated to those you just sold out of.

But, in my opinion, it still comes down to this: guessing. Purely guessing.

Myself, what I have seen evolving in the global marketplace in my short investing career (just 8 years), is an increase in the correllation of asset classes. What I mean is, you can no longer count on building a lower risk portfolio by speading investments across non-correllating asset classes, like small-cap to large-cap, value to growth, or domestic to international. It just seems like everything is moving in lock-step.

All I’m leading up to is this: I’m currently diversified across asset classes (small-cap, large-cap, real-estate, international, and some bonds) in order to get the best of all available returns. But I’m not for a minute thinking that if any one class falls hard, the others will “buoy” the rest of my portfolio. So, I’m closely watching all the info that Ulli is publishing, tracking some on my own, and “paying attention” for any changes. Taking money off the table? That just doesn’t work for me, and as someone once said, “…a man has got to know his limitations.”

What’s everyone else think?

G.H.

G.H.,

I think you’re absolutely correct.

A colleague of mine at work tries to do the “timing” thing and has been rather good at it, primarily because he stays in cash a lot of the time, and also regrets not having made certain investments!

Since nobody knows the future — else they’d be a multi-trillionaire — the best bet is to hang on for the ride as an investment goes up and create trailing stop orders for when those investments begin tapering off.

As the sayings go, “It takes money to make money,” but even more importantly, “Don’t lose money — it’s better to take several small losses than one big one!”

-Phil