- Moving the market

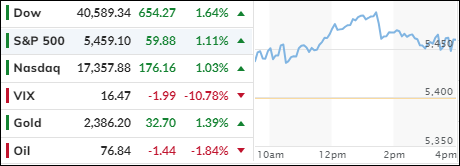

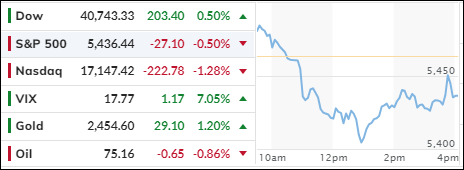

The stock market opened on a positive note but soon fluctuated around their respective unchanged lines, as traders focused on earnings reports and the Federal Reserve’s policy meeting. By the end of the session, only the Dow managed to close in positive territory, while the S&P 500 and Nasdaq ended in the red.

Interestingly, despite the Nasdaq being the top performer year-to-date and Small Caps lagging, today marked a point where both indices realigned.

Earnings reports have been well received so far, with about 80% of the more than 230 S&P 500 companies that have reported beating expectations. Analysts seem comfortable with the consensus earnings per share (EPS) and the corporate commentaries provided.

The two-day Federal Reserve meeting began this morning, with traders eagerly awaiting clearer signals about the timing and extent of rate cuts expected for the rest of the year. The likelihood of a rate cut in September has now risen to 100%.

The MAG7 stocks experienced a tumble but managed to rebound from their lows by the close. Meanwhile, most shorted stocks and semiconductors faced significant declines, reminiscent of last year’s performance.

The dollar suffered volatility but ended the day unchanged, while gold prices steadily increased. Bond yields slipped, Bitcoin approached $66,000, but Nvidia had a particularly rough day, losing nearly 8%.

This raises the question: Is this pattern still in play but on a much larger scale?

Read More