- Moving the market

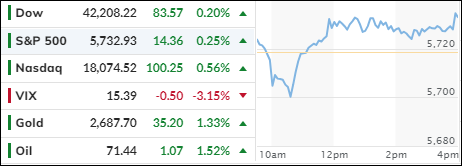

A series of positive data points helped ease traders’ fears that the Fed’s aggressive 0.5% interest rate cut might have been prompted by a slowing economy. This had a positive impact on the major indexes.

While the debate about the Fed’s actions continues, today’s sentiment favored the bulls. Initial weekly jobless claims fell, indicating a positive trend, while Durable Goods orders remained unchanged in August. Additionally, the final reading of the second quarter GDP was not revised, holding steady at 3%.

However, one set of numbers does not establish a trend. Particularly with jobless claims, the monthly figures will provide a clearer picture of market sentiment. Meanwhile, the Citi Economic Surprise Index saw another increase.

This combination of favorable economic news pushed the major indexes higher, with the Nasdaq leading the way. Micron, Applied Materials, and Lam Research were notable contributors, with the latter two gaining a solid 6%.

Central banks appear to be following the Fed’s lead by implementing stimulative measures. China announced fiscal support after earlier monetary measures, resulting in a significant jump in its index. The Swiss National Bank also cut rates by 0.25%, with traders anticipating further cuts in December.

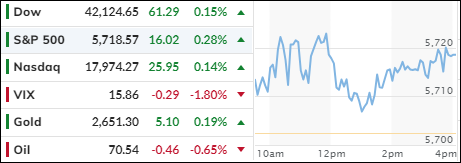

The most shorted stocks rose but lost some momentum as the session progressed. Crude oil fell below the $68 level, while gold hit new intraday highs above $2,700 but couldn’t maintain that level.

Bond yields were mixed, as was the dollar, which gave back some of yesterday’s gains. Bitcoin regained its $65k level for the first time since July. With global liquidity on the rise, this could bode well for the cryptocurrency’s pursuit of new all-time highs, as this chart demonstrates.

Read More