- Moving the market

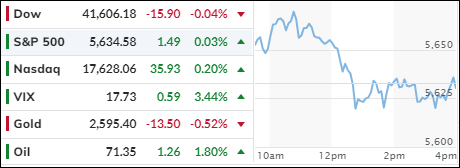

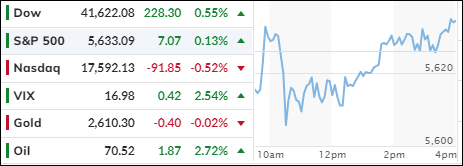

After yesterday’s Federal Reserve’s policy change, the bulls took charge early, propelling the Dow and S&P 500 to record highs. This surge was bolstered by a report showing weekly jobless claims fell by 12,000 to 219,000, significantly below estimates.

The tech sector embraced a “risk-on” mood, with Nvidia and AMD shares soaring around 5% and 4%, respectively. Other major tech stocks like Alphabet, Meta, and Micron also saw gains of 2% or more. The Fed’s decision to cut interest rates further benefited the banking and industrial sectors, with JPMorgan, Caterpillar, and Home Depot all seeing positive impacts.

The unexpected 0.5% rate cut, rather than the anticipated 0.25%, surprised Wall Street. Some analysts viewed it as a panic move, while others criticized it as an attempt to benefit the current administration ahead of the elections.

Despite differing opinions, today’s rally erased the S&P 500’s early September losses, pushing the index up by 1.2% for the month. Over 375 of the 500 index members posted gains for the day.

Small Caps and the Nasdaq led the charge, with the MAG7 basket reaching its August all-time highs. Although the most shorted stocks initially surged, they eventually leveled off and closed unchanged.

Bond yields were mixed, with the 10-year yield inching up slightly, while the dollar remained directionless. In contrast, Bitcoin marched higher towards the $64,000 mark, with the ARKB ETF gaining 5.3%. Gold also rallied towards its record highs but fell short.

The divergence between stocks and the 10-year yield remains as pronounced as ever.

How long can this unusual trend continue?

Read More