- Moving the Markets

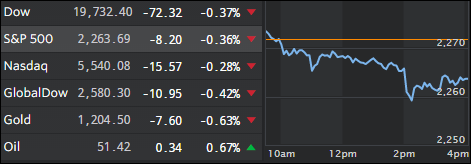

It was a mixed bag with upbeat economic news not being able to offset the anxiety about tomorrow’s inauguration. Besides sinking equities, bonds and gold dropped as well while the US dollar and crude oil bucked the trend and closed up.

On the economic front, housing starts rose but building permits inched slightly lower. Weekly initial jobless claims declined by 15k to 234k last week, which was below forecasts of 254k.

With the elite meeting in Davos, Switzerland, being in full swing, I saw this story confirming what I have been saying for a long time that all markets are manipulated by central banks. In this almost humorous article, China orders no market selloffs during President’s Davos trip:

State-owned investors bought shares to steady the market on Monday, while some funds were guided on Tuesday not to sell holdings with big weightings in benchmark indexes, the people said, asking not to be identified because they aren’t authorized to discuss the matter publicly. China’s securities regulators asked funds and brokerages to trade prudently this week and directed exchanges to report any abnormal transactions, the people said.

To be sure, Chinese authorities have traditionally intervened in markets before and during events of political significance, with government funds stepping in to boost stocks before a key meeting of the National People’s Congress last year and before a 2015 military parade celebrating the 70th anniversary of the World War II victory over Japan.

This is simply another confirmation that market manipulation is alive and well.