- Moving the Markets

An early rally attempt lost steam again late in the session with today’s spoiler being Secretary of State Tillerson, who took center stage and reversed his view from last week that the US had no interest in removing the Syrian president to now beating the war drums and announcing “that steps are underway to remove Assad,” and that the US is “considering an appropriate response to the Syrian government’s alleged use of chemical weapons.” Keep in mind, the emphasis is on “alleged.”

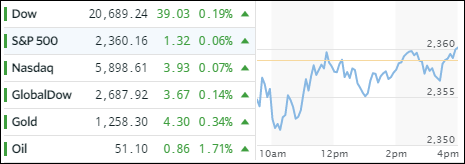

That took the starch out of any upward momentum, however, the major indexes managed to eke out a tiny gain. The 10-year Treasury yield went sideways and closed down 2 points or -0.85% hovering at a crucial support level, while Financials (XLF) gained +0.64% but remain stuck below their 50-day M/A.

The US dollar managed to squeeze out a gain for the 3rd day in a row as uncertainty remained high in regards to the outcome of Trump’s meeting with the Chinese president, which could have a dramatic effect on the dollar. Additional, we are waiting for Friday’s March employment report. Expectations are high due to the recent strong numbers released by ADP.