- Moving the Markets

Just yesterday, I talked about how bond yields have been slipping and sliding despite the Fed’s efforts of hiking rates in December and March. The 10-year yield has dropped from 2.62% to 2.26% over the past 4 weeks. That trend accelerated today as that yield got slammed even more ending up at 2.18% for a loss of -3.54%.

Bond markets are usually ahead of stock markets in terms of anticipating future events, and what this move indicates is what I have been talking about for a long time, namely that the economy is heading south in a big way. This has been evident when looking at hard data, such as GDP forecast, EPS expectations, retail sales, subprime auto loans and commercial real estate just to name a few. The only questions remains: when will the equity market get the message?

Not helping matters was a sharp tumble in the dollar (-0.79%) as the index broke below its psychologically important 100 level to close at 99.40. That is only a slip away from dropping below its 200-day M/A, which has functioned as a support level as recently as late March. Banks got hammered again with the loser of the year award going to Goldman Sachs which, as of March 1st had sported a YTD gain of almost 6% and has now slipped into negative territory showing a YTD performance of -9.73%.

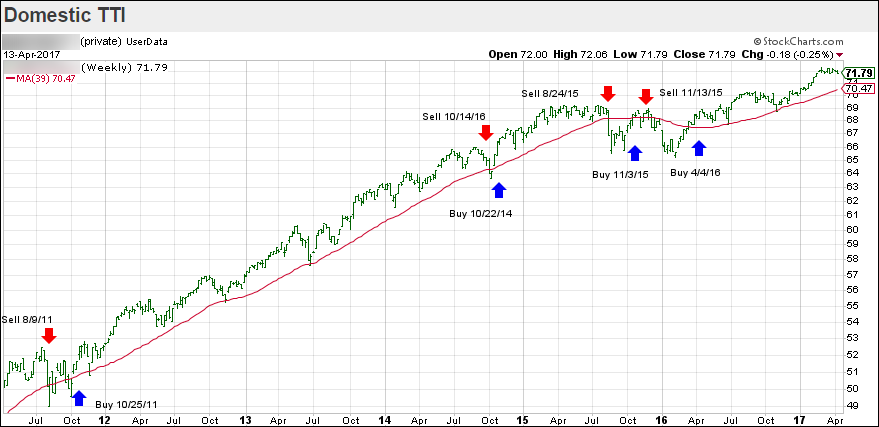

In case you like to see the visual, here it is: