ETF Tracker StatSheet

https://theetfbully.com/2017/06/weekly-statsheet-etf-tracker-newsletter-updated-06152017/

AMAZON SLAMS STOCKS BUT MAJOR INDEXES RECOVER

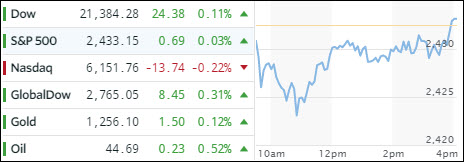

[Chart courtesy of MarketWatch.com]- Moving the Markets

Several events kept the indexes in roller coaster mode. For one, it was quadruple options expiration day, which always tends to add volatility to an otherwise complacent market. That fact got shoved into the background as Amazon announced its acquisition of Whole Foods, which collapsed shares of many grocers not just in the U.S. but also around the world.

Heavyweights like Kroger, Target, Walmart and Costco got slammed with their share prices losing anywhere from -5% to -9% at the close, which was a great improvement over losses early in the session. Pharmacies, drug distributors and REITs were negatively affected as well. The retail ETF XRT joined in and slumped -1.21%.

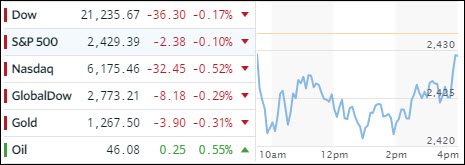

In the meantime, the economic “hits” continued unabashed with Housing starts suffering its worst streak since January 2009, dropping for the 3rd month in a row (-5.5%) bruising expectations of +4.1%. So, it’s no surprise that building permits also tumbled by -4.9% vs. expectations of +1.7%. Ouch!

In the bigger scheme of things, US economic data has not disappointed this much since August 2011, with the US Macro Surprise Index being hugely disconnected from the stock market as the chart below shows: