- Moving the market

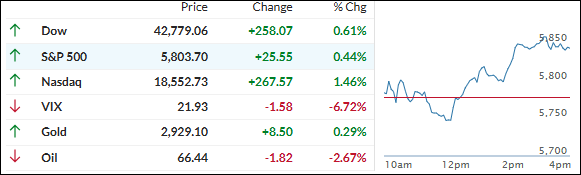

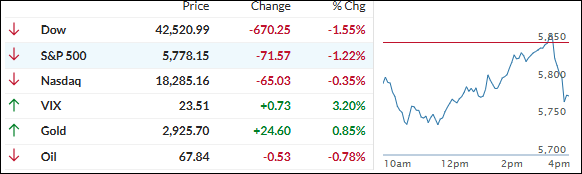

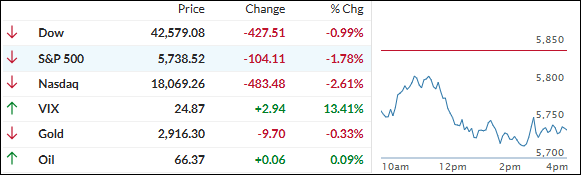

After a solid green close on Wednesday, the markets reversed course early on Thursday as traders sought more clarity on the latest tariff measures and their economic impact.

Despite Commerce Secretary Lutnick’ s announcement of likely one-month exemptions for “more than just carmakers,” markets remained mired in uncertainty throughout the morning and turned downward in the afternoon.

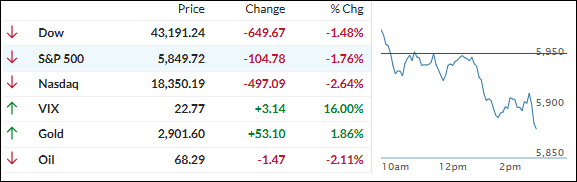

The markets faced a trifecta of trouble, as ZH described it:

1. Tariffs and broader policy uncertainty

2. The sustainability of the AI trade following DeepSeek

3. Upward pressure on sovereign rates, such as those in Germany

Traders’ aversion to uncertainty led to a downward trend, with mega-cap tech stocks selling off again and the Mag7 basket continuing to decline. Growth concerns, highlighted in various surveys, suggest that the threat of stagflation remains ever-present.

Adding to traders’ concerns, both the Nasdaq and S&P 500 broke their 200-day moving averages (DMAs) on an intra-day basis, which can signal a trend change from bullish to bearish, though prices bounced off that level.

Bond yields were mixed, with rate-cut expectations holding at three for this year. The dollar tumbled again, while gold traded steadily in a tight range above the $2,900 level. Bitcoin lost its $90k support ahead of tomorrow’s White House crypto summit.

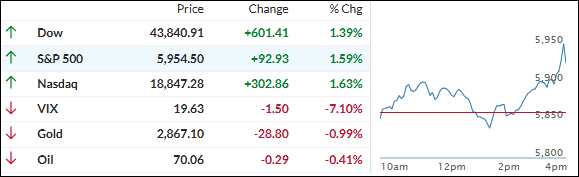

Friday’s highlights will include the eagerly anticipated non-farm payrolls report, which has been dubbed the “most important data point ever.” Depending on the outcome, we might see some fireworks in the markets.

Read More