- Moving the markets

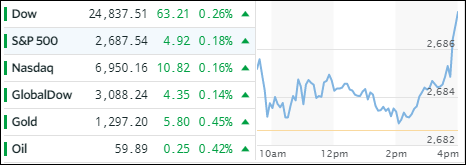

After much range trading for most of the day, the major indexes shot up during the last hour to not just only close in the green but to also push the Dow to its 71st record close for the year. The supporting actors turned out to be banking shares and to a lesser degree the energy sector with crude oil adding +0.42%. Despite low volume, the late session ramp seems to indicate that the bulls are alive and well.

In ETF space we saw predominantly gains with the only exception being Transportations (IYT), which gave back -0.31%. Other than that, the green numbers were pretty evenly spread across the board led by International SmallCaps (SCHC +0.63%), Emerging Markets (SCHE +0.47%) and MidCaps (SCHM) and Financials (XLF) each adding +0.39%.

Interest rates rose a tad with the yield on the 10-year bond gaining 1 basis point to 2.43%. Gold added +0.45% and is now knocking on the $1,300 ceiling, which has been a resistance point in the recent past, and it remains to be seen if this obstacle can finally be overcome. The US Dollar (UUP) again traded in a tight range, gapped down again and lost -0.29%.