- Moving the markets

The Fed stepped up to the plate and delivered the 3rd 25 basis point interest rate hike this year, which was widely expected but hope for ‘accommodation’ still powered an early rally that ran out of steam once reality hit the markets.

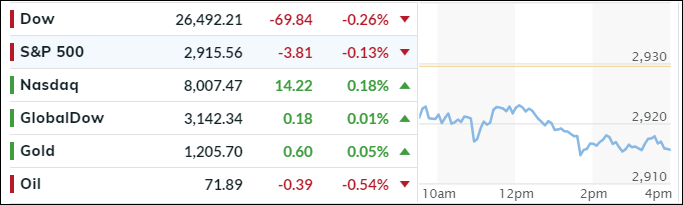

The major indexes reversed course, headed south and closed marginally in the red. Furthermore, the Fed indicated that a 4th hike in December would be a distinct possibility and that 3 more might follow in 2019.

Bond yields took a dive and shaved off 5 basis points to close at 3.05%; a level last seen on September 19th. The US Dollar swung wildly intra-day, but the closing price of UUP was only +0.04% higher, which did not reflect the see-saw action of the session. The Bloomberg Dollar Index demonstrates the irrational exuberance shown over the past week as ZH quipped: “Does this remind you of a penny stock?”

We’ll have to see how the markets will digest the interest hike hangover over the next few days. It very well may simply present an additional uncertainty in the basket of “things to worry,” with tough trade talk, a weakening housing market and bloating federal debt rotating to compete for the headline of the day.