- Moving the markets

Apple Computers started today’s market fallout yesterday afternoon by announcing weaker than expected iPhone sales and shockingly reduced its revenue guidance. Part of the blame was put on China due to the “magnitude of their economic deceleration.” The punishment was instantaneous with Apple’s stock dropping some 8% in the after-hours session.

With that backdrop, it did not take a genius to figure out that today would be disastrous for equities, and that’s exactly what happened. Right after the opening bell, the Dow plunged some 650 points, before a modest climb reduced traders’ anxiety somewhat but, at the end of the session, we set new lows for the day.

In addition to bearish Apple news, manufacturing numbers (ISM) were terrible and showed a decline to 54.1 in December from 59.3 vs. an expected 57.9. This was the biggest monthly drop since the financial crises, when in October 2008 it slipped by 9 points.

Everything plunged including bond yields with the 10-year sinking to 2.57%, its lowest level in a year. And as ZH noted, the 1-year bond yield is now only 2 basis points away from surpassing the yield on the 10-year making US recession fears even more realistic.

The US dollar fell as well, while only gold and oil showed some green numbers. The bear market is alive and well and has spread the suffering to well-known hedge fund managers, Warren Buffet’s Berkshire fund and the Swiss National Bank, which are all massive holders of Apple stock. Billions of dollars have been lost, as Apple has dropped some 31% in the past 3 months. Ouch!

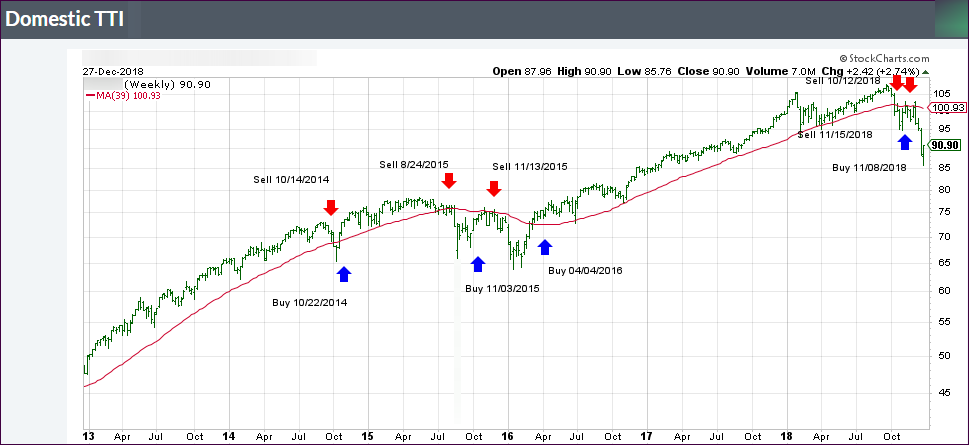

It’s good to be on the sidelines, because the way things look there may be much more pain to come.