- Moving the markets

For a while, the markets looked like attempting to repeat yesterday’s feat, namely that an opening dump would be followed by a slow and steady recovery back above the unchanged line. However, mid-day the developing rebound hit a brick wall, reversed, and south we went taking out the early morning lows.

Causing this weakness was Trump’s threat to slap some $11 billion of tariffs on European Union (EU) goods, as retaliation against European subsidies for aircraft manufacturers. Considering that the trade battle with China is still unresolved, this second line of combat is seen as an additional “disrupter” of the already weakening global economies.

On the domestic economic front, we learned that job opening plunged by 538k, which was the biggest drop in 42 months. To me, that is not a surprising development given that most economic data points over the past few months have been anything but encouraging.

The stock market has been ramping higher with total disregard to underlying fundamentals, even though bond yields have been slipping and indicating that not all is well. In the meantime, the Fed has virtually guaranteed that there will be no rate hikes in 2019.

My guess is that they will likely lower rates by mid-year to stimulate activity, as the dreaded “R” word, as in recession, will likely be uttered by the Main Stream Media in the not too distant future.

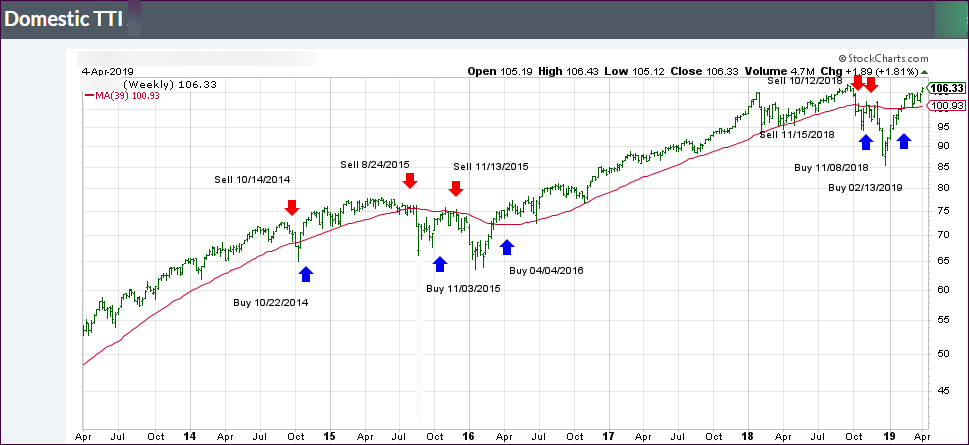

Today’s pullback moved our Trend Tracking Indexes (TTIs) off their lofty levels, but they remain firmly entrenched on the bullish side of their respective trend lines (section 3).