- Moving the market

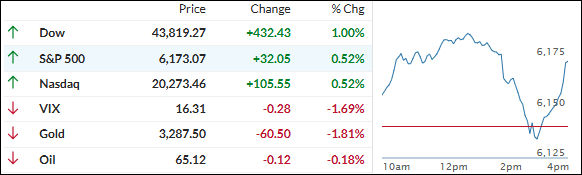

The first trading day of July came in with mixed vibes. The S&P 500 and Nasdaq stumbled out of the gate, while the Dow decided to do its own thing and posted some early gains.

Tesla took a 4% hit after former President Trump stirred the pot on social media, suggesting that DOGE should investigate the government subsidies Elon Musk’s companies have received. This seemed like a clapback after Musk called Trump’s latest “big, beautiful bill” completely insane and destructive. So yeah, the drama continues.

Meanwhile, Fed Chair Jerome Powell spoke at a European banking forum in Portugal, saying the Fed probably would’ve cut rates again by now—if it weren’t for those pesky tariffs. He didn’t offer any timeline, just the usual “we’ll see what the data says” line. Not exactly the clarity markets were hoping for.

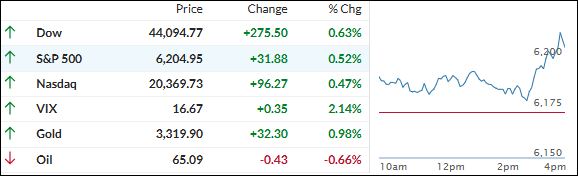

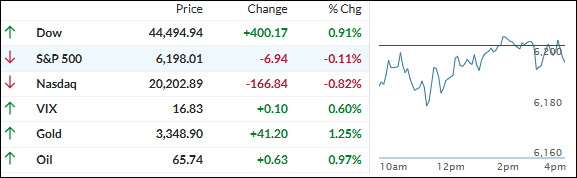

The weakness in the S&P and Nasdaq stuck around through the close, and Trump’s comment about not extending the tariff pause past July 9th didn’t help. Even a big short-squeeze couldn’t lift the Mag7 tech giants, though it did give the broader market a bit of a boost.

Bond yields climbed, rate cut hopes dipped, and both hard and soft economic data came in weak. The dollar had a wild ride but ended flat. Gold bounced back nicely, reclaiming its 50-day moving average after yesterday’s quarter-end drop. Bitcoin slipped alongside tech but found support around $106K.

So, with a shaky start to July, the big question is: Will the market stick to its usual seasonal script and rally over the next couple of weeks—or is this year going to break the pattern?

Read More