- Moving the market

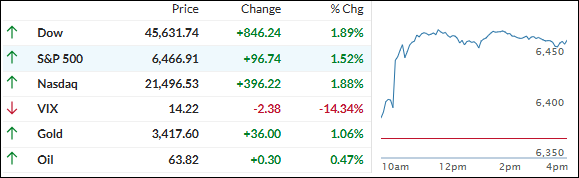

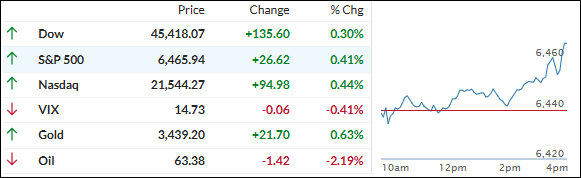

Wall Street turned in a steady performance today after a bumpy start to the week. The major indexes ended slightly higher: the S&P 500 gained 0.4%, the Nasdaq rose 0.44%, and the Dow edged up 0.3%.

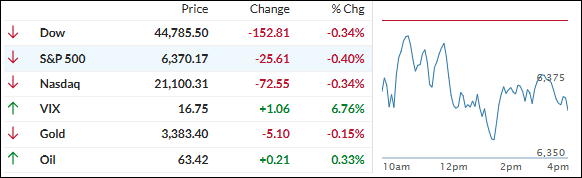

I believe traders are keeping a close eye on ongoing drama between the White House and the Federal Reserve, especially as President Trump tried to oust Fed Governor Lisa Cook—an action that’s raising real concerns about Fed independence and the path of interest rates.

Bond yields dipped modestly; the 10-year Treasury yield eased to around 4.26% as investors factored in the likelihood of a more accommodative Fed later this year. Surprisingly, news around Fed shakeups didn’t spook the market much, though any hints of political interference are sure to stay on traders’ radar.

As for the “Mag 7” stocks, Nvidia stole the spotlight with another rally ahead of its earnings and AI headlines, while the rest of the big techs were mostly quiet except for bits of action in pharma and chips. The dollar slipped a little against major currencies, helping risk assets.

Gold picked up slightly, nearly touching record highs as the Fed’s independence came into question and global investors shifted defensively. Bitcoin was mostly flat, stuck as traders waited for the next big catalyst to materialize, but macro data had a solid showing.

It’s my view that the market’s managed to hold up well, but the mix of Fed uncertainty, trade talk, and upcoming Nvidia results means we’re still in headline-driven territory.

Will new data or political moves shake up this calm—stay tuned!

Read More