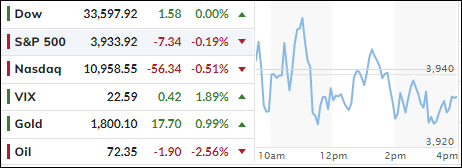

- Moving the markets

After 4 days of declines, the major indexes vacillated around their respective unchanged lines and, despite several breakout attempts, nothing was gained or lost. The exception was gold, with the precious metal adding 1% and closing right at its $1,800 level.

Worries about a worsening recession in 2023 remained on traders’ minds, along with critical upcoming data releases. Jobless claims on Thursday, November’s PPI and preliminary consumer sentiment on Friday will set the stage for next week’s highlights.

On Monday, we will find out whether the CPI has worsened or improved, and on Wednesday, the Fed will either deliver an expected 50 bps rate hike or an unexpected 75 bps. Either one will have an influence on market direction.

Today, even a plunge in bond yields was not enough to support equities, even though the 10-year dropped 11 bps to 3.43%, which caused the US Dollar to stumble and Gold to rise.

We may see some churning and grinding in the indexes until guesswork and uncertainty about the above-mentioned upcoming data sets are removed.

Read More