- Moving the markets

Yesterday’s rally of hope hit a brick wall this morning, as the markets appeared unable to string a couple of winning sessions together, thereby still being stuck trading in a broad trading range.

Good news was bad news again when ADP’s private payroll report showed that 235k jobs were added in December, which exceeded expectations. Wages also increased more than anticipated, which means that the labor market remains strong.

This is interpreted as bad news on Wall Street, since it will likely affect the Fed’s next moves by maintaining their hawkish policies, as gains in wage growth translates into potentially higher inflation, which supports their theme of continuing their rate hikes with the result that equities will succumb to bearish forces.

Tomorrow, the December jobs report will be on the agenda and, if it syncs up with today’s ADP numbers, we could see more downside momentum develop. Right now, market direction is clearly determined by the latest econ news releases, which can push equities in either direction.

Uncertainty reigns!

Continue reading…

2. “Buy” Cycle Suggestions

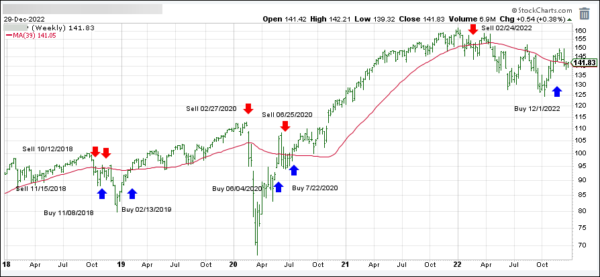

For the current Buy cycle, which started on 12/1/2022, I suggested you reference my most recent StatSheet for ETFs selections. However, if you came on board later, you may want to look at the most current version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend for you to consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices. I can see this current Buy signal to be short lived, say to the end of the year, and would not be surprised if it ends at some point in January.

In my advisor practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

Our TTIs finally gave back some of yesterday’s advances but remain stuck on the bullish side of their respective trendlines.

This is how we closed 01/05/2023:

Domestic TTI: +0.57% above its M/A (prior close +1.62%)—Buy signal effective 12/1/2022.

International TTI: +3.49% above its M/A (prior close +3.99%)—Buy signal effective

12/1/2022.

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

All linked charts above are courtesy of Bloomberg via ZeroHedge.