- Moving the market

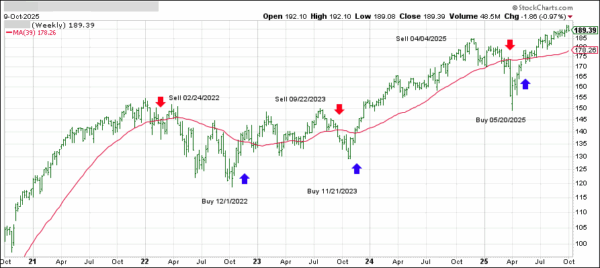

The Dow pulled off an impressive comeback early on, shaking off a plunge of over 600 points as traders tried to see past the latest twists in U.S.-China trade tensions.

While tech stocks like Nvidia remained stuck in reverse, a strong kickoff to earnings season offered a reassuring sign that corporate fundamentals are still holding up.

Standout results from Citigroup and Wells Fargo propelled their stocks up 3.4% and 7%, while JPMorgan and Goldman also beat forecasts but still finished down on the day.

Markets opened lower after fresh moves from China to tighten its control on global shipping—and after Beijing slapped sanctions on five U.S. subsidiaries of Korea’s Hanwha Ocean, essentially freezing business ties.

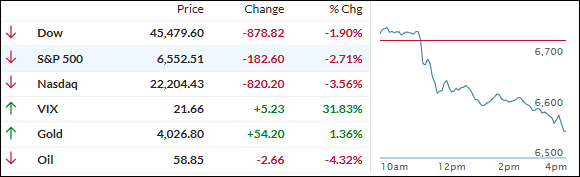

That added fuel to an already volatile backdrop, especially after Trump last week threatened to double tariffs on China, moves that sent the Dow tumbling more than 800 points on Friday and the S&P 500 to its worst session since early April.

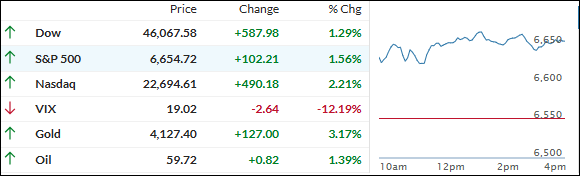

Trump tried to dial back the rhetoric over the weekend, posting “Don’t worry about China, it will all be fine,” triggering Monday’s rally.

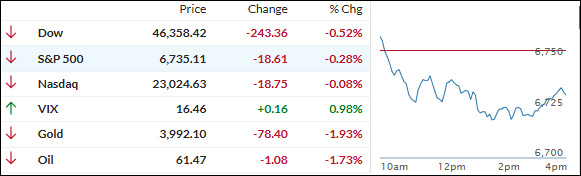

Today, however, that upbeat mood faded amid a new round of China headlines and Fed Chair Powell’s dovish remarks, which gave the market a brief lift before stocks closed mixed—only the Dow ending in the green.

Gold shot to another record before fading late, and silver had a volatile run, jumping above $53 then slipping.

Tech was the weakest link as “Mag 7” names lagged the S&P 500. Bond yields bounced around but ended a tad lower, with the 10-year briefly dipping to 4%. The dollar softened while bitcoin whipsawed but closed at $113,000, down for the day.

Uncertainty still rules the day: Will tech finally catch a break, or are markets in for more whiplash as the back-and-forth in trade talks drags on?

Read More