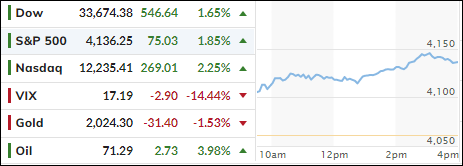

- Moving the markets

As I suspected yesterday, today’s session might not be much different, and that’s how it turned out. While inflation data, to be released tomorrow and Thursday, loom large, Treasury Secretary Yellen decided to increase the “fear meter” by announcing that failing to raise the debt ceiling would be an economic catastrophe, referring to this afternoon’s “conversation” between Biden and McCarthy.

As a result, traders and algos alike stayed away from making any key commitments, causing the major indexes to chop below their respective unchanged lines. Whether the inflation numbers are interpreted as being “sticky” or not will determine future market direction. As will acceptance of the fact that banking stresses will not just disappear, lending conditions may tighten, and increased reserve requirements will lead to fewer loans and a struggling economy.

Adding to these general uncertainties were hawkish comments from the Fed’s Williams, as ZeroHedge alluded to:

“What we’re signaling is we’re going to make sure that we achieve our goals and going to assess what’s happening in the economy and make the decision based on that data,” he said. “And if additional policy firming is appropriate, then we’ll do that.”

“I do not see in my baseline forecast any reason to cut interest rates this year,” he said, adding that the economy began the year on a solid footing, and he saw two-sided risks to the outlook. “In my forecast we need to keep restrictive stance of policy in place for quite some time.”

We have heard these kinds of words for almost a year, but the markets have not caught on and stubbornly cling to the belief that the Fed will cave and pause or pivot. Only time will tell.

The regional banking sector ETF KRE slipped, as the latest cockroach (PACW) pumped and dumped. The markets followed in similar fashion, but a worse outcome was avoided, as a short squeeze sort of saved the day.

Bond yields climbed, with the 2-year finally conquering its 4% level again. The US Dollar continued yesterday’s rally but sold off into the close. Gold ramped higher and captured the $2,040 level.

All eyes are now on tomorrow’s CPI report. Stay tuned.

Read More