- Moving the markets

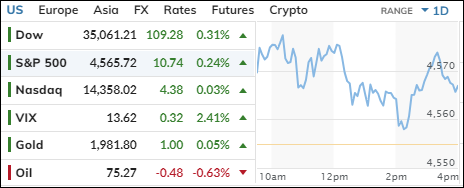

The Dow Jones Industrial Average had another good day on Wednesday, rising for the eighth day in a row with some help from the short squeeze crowd. That’s the longest streak of gains since September 2019, as investors celebrate the strong earnings season, ignoring the fact that the expectations were low to begin with.

The Dow didn’t care about Goldman Sachs’ disappointing earnings report, which showed losses in real estate. The bank had already warned that the quarter would suck, so no one was shocked.

Meanwhile, most of the companies in the S&P 500 that have reported results have beaten the low bar, according to FactSet data. This makes some people think that the economy is slowing down gently, rather than crashing hard.

The inflation data last week also calmed some nerves about rising prices, even though that might have been a fluke. Bank earnings have been less bad than expected and have helped us to forget the spring meltdown. The market is hoping that the banking sector is out of the woods, and that history won’t repeat itself. Yeah, right.

On the flip side, the housing market cooled off a bit in June, as both housing starts and building permits fell from May. Housing starts also got a downward revision for May. The only silver lining was single-family building permits, which rose for the sixth month in a row. Multi-family permits and starts, however, dropped in June.

That dragged the US macro data index down another notch, which was the biggest 2-day drop since January 2022. But the KBW banking index kept climbing out of its hole and scored another win.

Both Apple and NVDA had a brief scare when news of Apple building an AI platform turned out to be a lame imitation. The stock ripped and dipped but recovered for the day. Sometimes you just have to laugh…

Bond yields were mostly lower, the dollar was stronger, and gold wandered around but ended up slightly higher.

The gap between the S&P 500 and High Yield Credit (HYG) has widened even more, as this chart shows.

What could possibly go wrong?

Read More