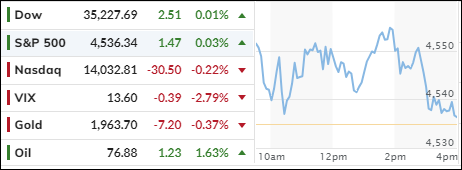

- Moving the markets

The Dow kept its winning streak alive for the 12th day in a row, shrugging off mixed earnings and the looming Fed decision on rates. Traders and algos were in a bullish mood, pushing the index to its highest level in six years.

Some earnings highlights: GM skidded 4% even after raising its outlook, GE soared 6% on a strong report card, and UPS slipped despite averting a strike with the Teamsters.

Google and Microsoft are up next after the bell. So far, 79% of S&P 500 companies have beaten the low bar of analyst expectations for Q2.

The Fed is widely expected to raise rates by 0.25% tomorrow, but the big question is what they will do in September? Many hope that inflation is under control and on track to hit the Fed’s 2% target, so no more hikes are needed.

But what if inflation comes back with a vengeance, as I suspect it will? Hmm…

Consumer confidence surged to a two-year high, while inflation expectations dropped to a 10-month low. These numbers boosted the Economic Surprise Index, which had been lagging lately.

But financial conditions are still as easy as they were when the Fed started hiking rates by 0.5% in May 2022. That’s probably not what they had in mind after five hikes totaling 5%. If that didn’t do much, more hikes are likely, and the odds of another one before year-end are now at 50%.

Banks reversed course after yesterday’s bounce, bond yields edged up, the dollar stayed in a tight range, and gold was choppy with its ETF adding +0.53%.

It’s no secret that insiders know best, and they have been bearish while retail investors drove this market melt up, as this chart shows.

Will they be proven right?

Read More